Trading Accounts

Trading Conditions

Financials

Trading Instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaLike oil, natural gas is a product of decomposed organic matter, typically from ancient marine microorganisms, deposited over the past 550 million years. Often, gas and oil are neighbors, who are located deep under the ground. Because of that, their prices sometimes correlate. But for the last several weeks gas was skyrocketing at an enormous pace. It has gained more than 17% from August 18. What is the reason for such moves and how can we earn on global gas trading?

Assessment of the Natural Gas market should start with basic points. Usually, there are a set of reasons for the commodity price to change:

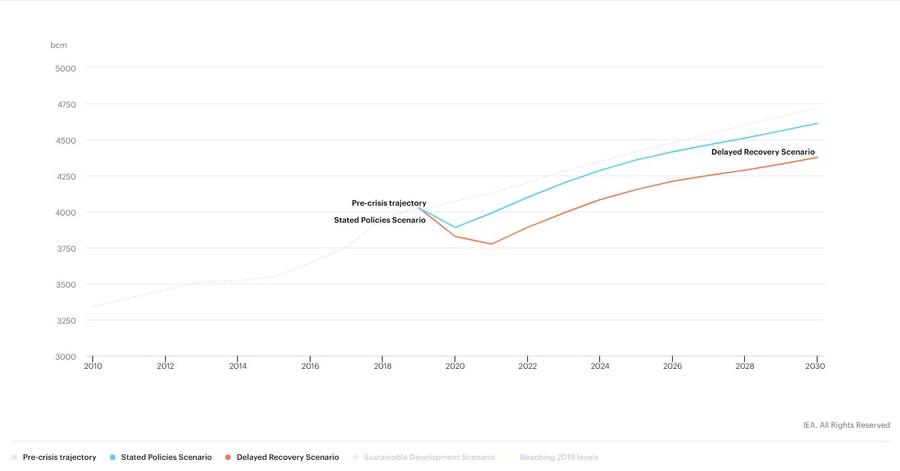

Let’s go through every reason to create a natural gas price forecast. As for now, demand isn’t showing any signs of slowing down. Between 2009 and 2020, global gas consumption surged by 30% as utilities and industries took advantage of booming output. Even in the covid-19 environment, experts are expecting the demand to rise even more in the next 10 years.

Source: https://www.iea.org/data-and-statistics/charts/global-natural-gas-demand-by-scenario-2010-2030

As for ecological reasons, companies and countries are implementing gas in their electrical supplies. The shift to natural gas can be done relatively quickly and cheaply while having a significant impact on lowering emissions. Natural gas is the cleanest burning fossil fuel and emits almost 50% less CO2 than coal. Meanwhile, non-fossil-fuel alternatives such as wind and solar are at a relatively early stage to produce enough energy and offer a cheap deployment.

Already, there are signs around the world that supplies will fall short:

Even if the prices will rise even higher over the next decade, it won’t be enough to drastically reduce demand for the fuel. All we can say for now is that gas is increasingly less dependent on oil prices and this trend is going to continue.

As for the chart, US natural gas is several days away from volatility increase. For now, the price is consolidating in a triangle and the breakout will decide its fate. In case of further growth, it is highly likely for the RSI divergence to form. That would be a sign of a pullback.

XNG/USD H4 chart

Support: 5.60; 4.94; 4.20

Resistance: 6.30; 6.50; 7.00

To trade natural gas, we need a trading strategy. And to have one we need to better understand the asset. Here are some tips for traders that will surely help you.

If to perform trade analysis via technical indicators, the best for gas right now is RSI, because it can show you the divergences between the indicator and the price and spot possible reversal earlier, than others.

No growth is everlasting, and though the gas price has been skyrocketing for the last weeks, most of the time it lacks the volatility. So when this “Gas season” will be over, consider looking at the cryptocurrency, because it’s much more volatile. Also, 24\7 crypto trading means that you don’t need to wait for the market opening, just open your FBS Trading Platform or Meta Trader and enjoy the possibilities of a crypto trading account.

Now you know how to trade natural gas, so what are you waiting for?