Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaAlibaba will publish its earnings on Wednesday, May 12, at 14:30 GMT+3 for the fiscal quarter ending March 2021.

Expected EPS: $1.47

While being one of the most aggressively expanding Chinese global e-commerce corporations, Alibaba has been in the turmoil since the end of 2020 as its native government is scrutinizing the entire market for antimonopoly violations. If that’s the true reason for the Chinese regulator’s crackdown on the corporate world, Alibaba has little to respond with. Indeed, a month ago, Jack Ma’s company was found responsible for undercutting the IT-commerce market competition. As a result, Alibaba has a fine of $2.78bln to pay for the violation of the anti-monopoly regulations.

While being possibly the greatest corporate penalty even recorded in history, this amount doesn’t take more than a few percent from the company's yearly sales. As huge as it is, it is not as important as the intention behind it: people with knowledge of the matter explain the Chinese government is essentially aiming at reducing Jack Ma’s empire to more controllable extents. That means the penalty is not a “side effect” of an otherwise impartial industry stirrup just to improve the business environment. Rather, Alibaba was targeted to reduce its influence and let others come into play.

That may mean long-term troubles for the company – especially if Jack Ma allows himself any sort of critique he allegedly did before with regards to the Chinese financial system. As supportive of the market competition as the Chinese government is, it is not as nearly liberal towards freedoms of political self-expression as the West is. Therefore, fundamentally, Alibaba’s future is quite blurred and has to be considered so – at least, until and unless there are solid indications otherwise.

Remember you can trade Alibaba in MT5 and FBS Trader!

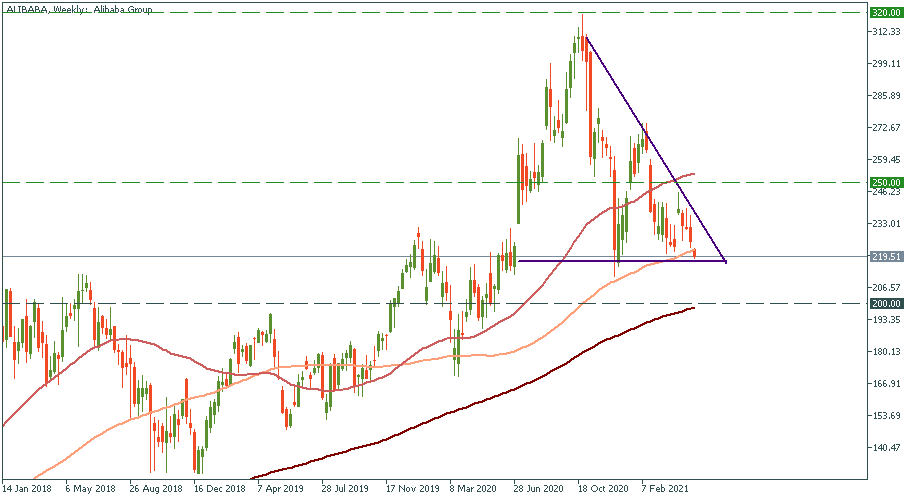

In the previous quarter, Alibaba brought an EPS of $2.98 against the expected $2.78. The estimation itself was considerably higher than the previous quarters of the year, and exceeding these forecasts eventually made the stock peak at its all-time highs of $320 in October/November 2020. After that, as the Chinese government opened the case against Alibaba, the stocks have seen but a plunge. It lost $100 of value since then – that is almost 30% of its all-time high value.

The truth is that even if Alibaba’s sales impress the market, the company is going to stay in the crosshairs of the state regulator, and it won’t be let to expand as much as it used to or as much as it would like to. That’s why, with all the temptation to pick the stock at its lows, traders should be prepared to see its long-term sideways movement.

$200 seems a plausible target for bears, especially if sales are not that good. Triangle-like chart pattern also suggests possible downside and breaking the support of 100-MA to lower levels. Otherwise, $250 will be capping the upside in the observable future. Only if that level is broken, Alibaba stock price may be considered as planning to reach the all-time highs again.