Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

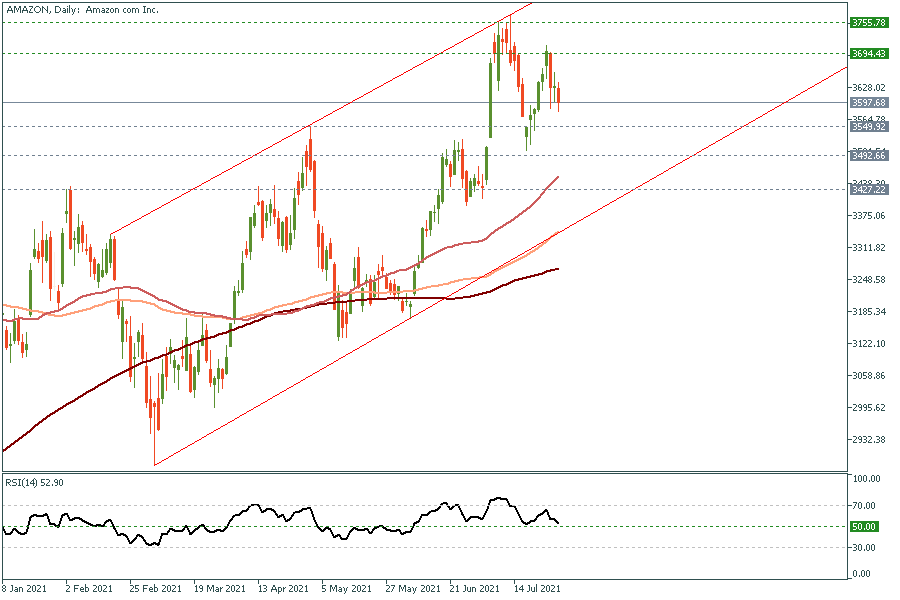

Personal areaThe world’s biggest e-commerce retailer on Thursday reported sales and gave a forecast that fell short of expectations. Shares declined by about 7% in the extended trading after the results were released. It marked the first time Amazon had missed quarterly sales estimates since 2018.

To be honest, this shouldn’t be a surprise. Amazon emerged as the essential store for homebound shoppers during the coronavirus pandemic, propelling its sales and profits to new highs. Now, the rush online is slowing down as vaccinated consumers peel away from computers and smartphones and revert to old habits like traveling and dining out.

Q2 sales increased 27% to $113.1 billion, missing the $115 billion estimated. While profit was $15.12 a share in the period ended June 30, compared with the average estimate of $12.28.

Nevertheless, Amazon is optimistic about the current quarter saying that revenue will be $106 billion to $112 billion in the period ending in September. Operating profit will be $2.5 billion to $6 billion. If so, this would cover the disappointment of Q2. With that being said, I would consider the current decline in Amazon as another price discount that many are waiting for.