Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaFor a long time, US Federal Reserve printed trillions of dollars to support the economy. But in the light of the highest inflation in almost 40 years, the stream of stimulus tends to shrink. The rotation of the sectors may increase the money flow in banks. We will talk about three of them in this article, not because they are in some way unique, but because these three will release earnings reports today, on January 14.

Large banks reported a record-high increase in revenues in 2021. As a result, banks stocks are raging into earnings season as their upcoming results are expected to show the US economy continuing to roll even in the face of inflation.

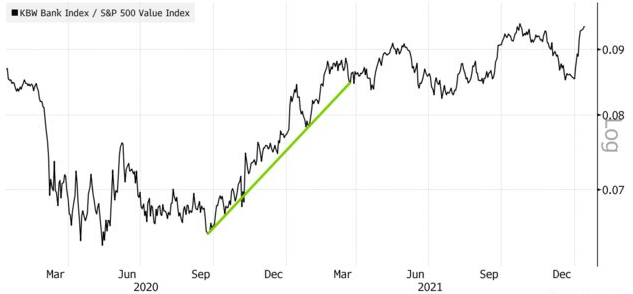

KBW Bank Index relative to the S&P 500 Value Index shows a strong bid for lenders since the start of the year, thanks to bets on rate hikes as soon as March and expectations of strong fourth-quarter results.

The figure above shows that banks have outperformed the stock market since September 2020. Will the tendency remain?

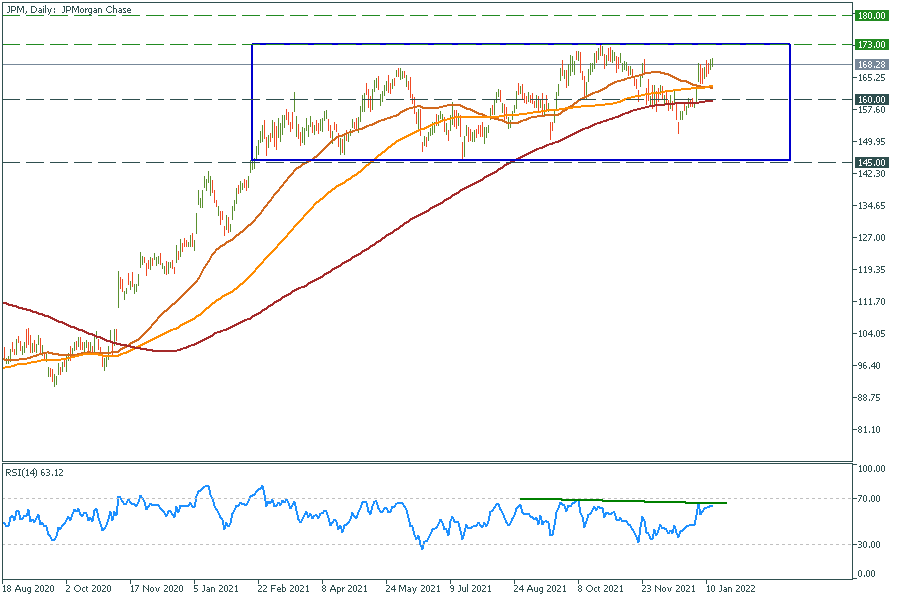

JPMorgan Chase & Co (JPM) will release its earnings report at 14:50 GMT+2. It is expected to have -2.6% revenue growth, with estimated EPS at $2.98 and revenue at $29.71B. JPM is the largest US bank by assets, and it has reported soaring profits over the past year. But most of the earnings came from the release of the loan loss reserves. On the other hand, revenue growth, a key driver of long-term profits, has been weak.

JPM Daily chart

Resistance: 173.0; 180.0

Support: 160.0; 145.0

As for the chart, we see a vast consolidation phase starting from January 2021, and considering upcoming rate hikes (a bullish sign for the banks), we expect the stock to start a strong uptrend in several months. JPMorgan's shares have slightly underperformed the broader market over the past year. Shares of the company rose by 23% over the past year, with US500 total return of 24.3%

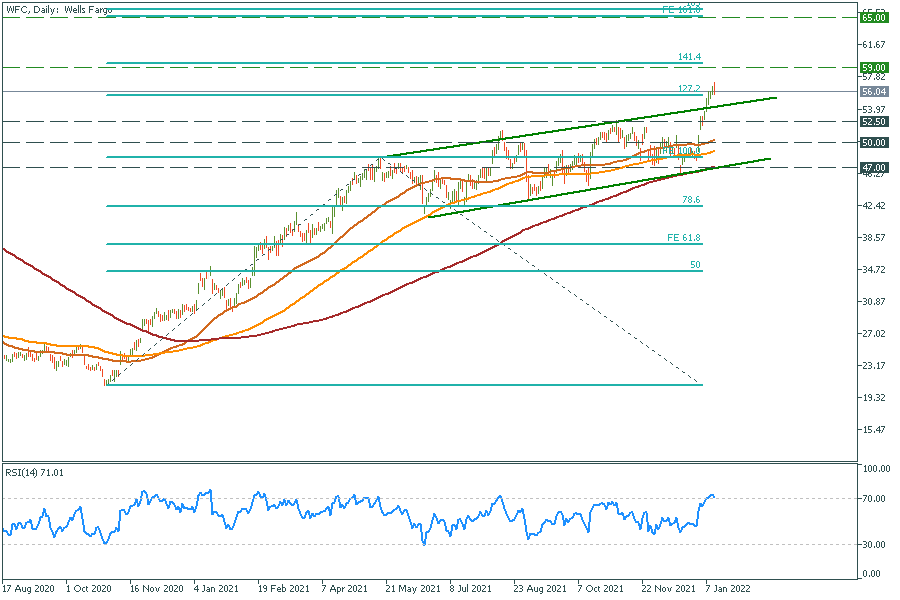

Wells Fargo & Co (WFC) will release its earnings report at 15:00 GMT+2. It is expected to have -3.9% revenue growth, with estimated EPS at $1.09 and revenue at $18.38B. The company has surprised the market with better-than-expected EPS four times in a row.

Nevertheless, there is a thing you should worry about. The stock broke through the ascending channel days before the earnings report. Such movement means that the report is expected to be unusually good. Also, it is often to see an instant plunge after good reports because of the "sell the fact" effect. Luckily, there is plenty of time to prepare for trading WFC because their report comes out 2.5 hours before the market opens.

WFC Daily chart

Resistance: 59.0; 65.0

Support: 52.5; 50.0; 47.0

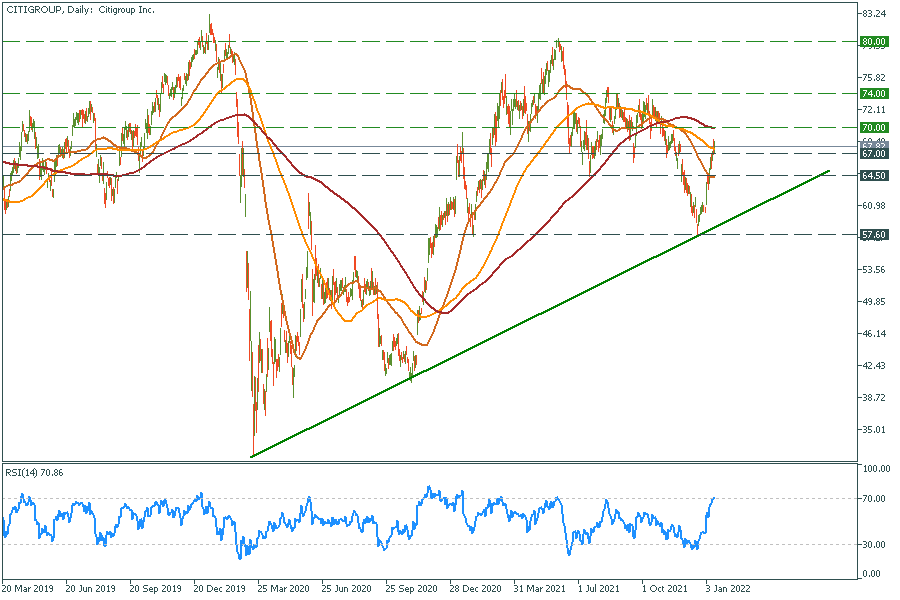

Citigroup, Inc. (CITIGROUP) will release its earnings report at 16:00 GMT+2. It is expected to have -10.7% revenue growth, with estimated EPS at $1.89 and revenue at $17.03B. Citigroup recently agreed to sell its consumer-banking franchises in Indonesia, Malaysia, Thailand, and Vietnam to United Overseas Bank. Its strategy is to exit most of the bank's retail operations in Asia and free up resources. The deal size is $3.7 billion. Although the news is fresh, shares of the company have been skyrocketing since December 21, after the company said it would start the buyback program.

As the RSI is close to the overbought zone and the price is near 100 and 200 daily MA, we expect the stock to correct after the report. The main support lines are $67 and $64.5 per share.

CITIGROUP Daily chart

Resistance: 70.0; 74.0; 80.0

Support: 67.0; 64.5; 57.6

Notice that trading stock with FBS starts at 17:30 GMT+2, so you have plenty of time to prepare yourself. Also, volatility tends to increase right at the beginning of the trading session. Thus, it is better to wait a little bit and understand the stocks' local trend.