Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaWhile growth stocks have stepped back in the first quarter of 2021, cyclical stocks have come to the fore. The term ‘cyclical’ refers to a stock in which business generally follows the economic cycle of growth and recession. In other words, cyclical stocks are rising in times of economic expansion but falling during recessions and market instability. Indeed, stocks involved in such sectors as technology, e-commerce, online shopping, and streaming services skyrocketed amid the long Covid-19 lockdowns, but have already started falling amid ongoing recovery.

The travel and hospitality industries have been hit hard by social distancing restrictions amid the pandemic. Since the constraints are easing, people are more willing and able to spend money on traveling. Thus, such stocks as Booking, TripAdvisor, Royal Caribbean, and Carnival are edging higher.

For instance, TripAdvisor is getting closer to the high of March 4 at $55.00. If it manages to break it, the way up to the next round number of $60.00 will be clear. Support levels are at the recent lows of $50.00 and $47.50.

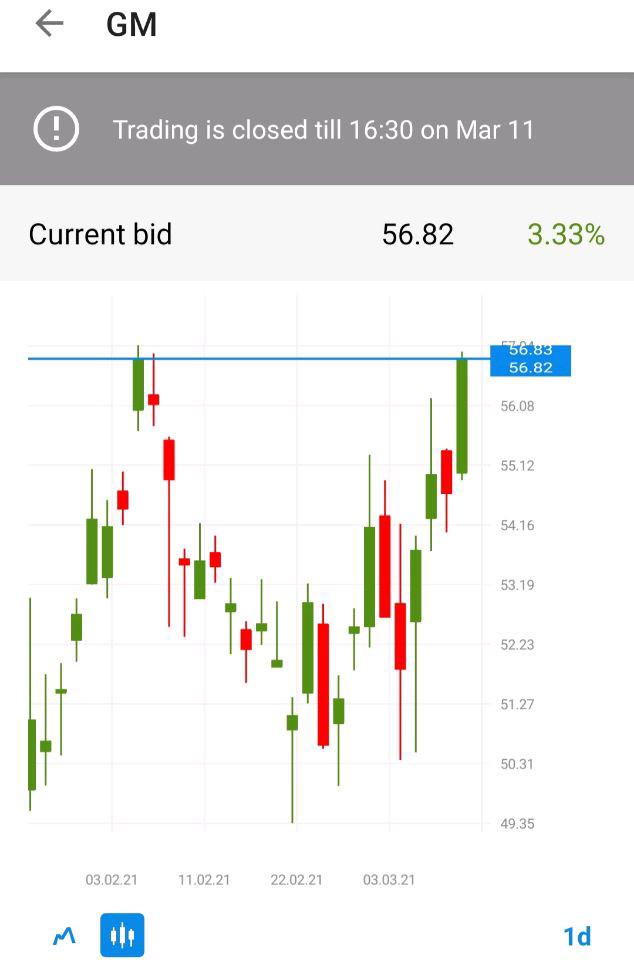

Automakers tend to fall during recessions as consumers save money and keep their old vehicles instead of buying new ones. In opposite, people are more motivated to buy new cars during expansion. Therefore, such stocks as Ford, General Motors, and Ferrari are likely to jump in 2021.

If General Motors manages to break through the resistance of $57.00, the dorrs to the psychological level of $60.00 will be open. Support levels are $50.00 and $45.50.

Banks are usually losing their profits during recessions. Most people stop taking mortgages, and loans or even struggle to pay their debts. Besides, interest rates tend to fall before and during recessions, as a result, banks’ profit margins decline. JPMorgan, Goldman Sachs, and Bank of America should rise in 2021 amid the global economic recovery.

JPMorgan is climbing up and up. If bulls keep momentum, it may reach the next round number of $160.00. Support levels are the low of February 26 at $147.00 and the low of February 11 at $140.00.

Remember that with FBS you can make both buy and sell trades. Thus, traders have a chance to profit in case of either outcome!

Note that the stock exchange has a schedule. Trading starts at 16:30 MT time.

Don't know how to trade stocks? Here are some simple steps.