Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

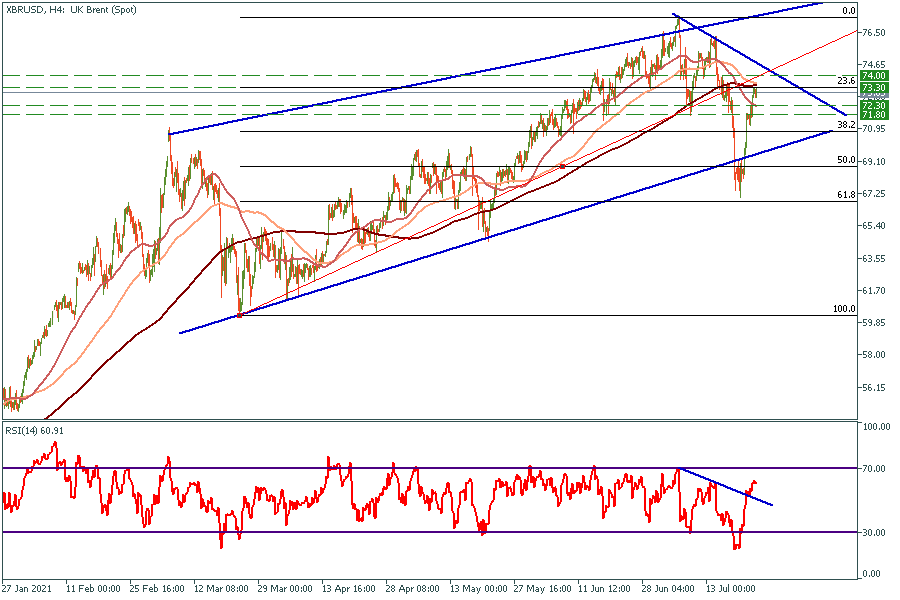

Personal areaBrent returned to the rising channel on Wednesday by gaining 4% during the trading session. Investors are still looking towards risk assets despite data showing an unexpected rise in US oil inventories.

The fall was caused by the deal between members of the Organization of Petroleum Exporting Countries and allies, known as OPEC. The organization decided to raise supply by 400,000 barrels a day from August to December 2021. Investors were also scared about the new COVID Delta strain.

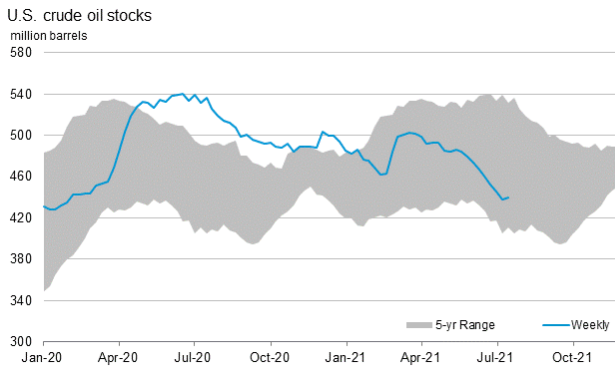

Oil price keeps growing, despite the fact that the US crude stockpiles went up for the first time since May. Investors are positive about the future as they are sure that the demand will exceed supply during 2021.

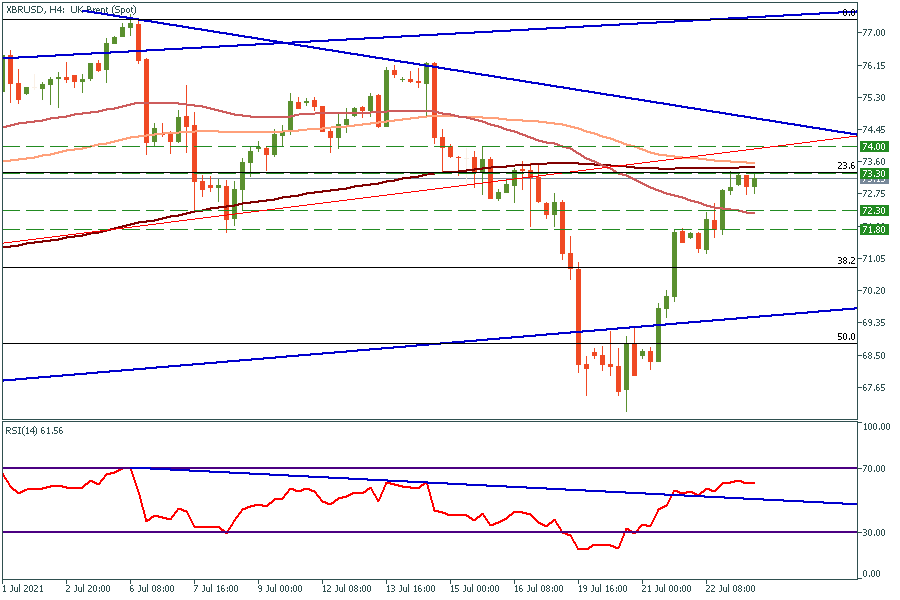

4H Chart

At the moment, the price is trying to break $73.3 resistance. It is an intersection of 100 and 200 period moving averages, also it is 23.6 Fibonacci level. On the RSI oscillator, the downtrend has been broken, which means bulls still have enough power to push Brent higher.

In the short term: If the price breaks $73.3 resistance, it will shortly reach the 74-74.5$ range. Otherwise, it might test the 50-period moving average at the level of 72.3 before the upcoming raise.

In the long-term: As the price breaks the $73.3 resistance level, it will head towards the top line of the rising channel with a target range between $77.3-$77.7.