Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThis week began with several positive news which made investors feel confident about future global economic recovery.

China's apparent success in fighting the Delta variant of the coronavirus, with no cases of locally transmitted infections in the latest data. Moreover, on Monday the U.S. Food and Drug Administration issued full approval for the Pfizer/BioNTech two-dose vaccine. The World Health Organization reports the number of new Covid-19 cases "seems to be plateauing" after increasing for nearly two months.

Brent has always been the driver of economic recovery and development. In this article, we will discuss why the end of the pandemic is equal to the beginning of the new raw material cycle.

Let’s check the global Brent oil futures chart!

Brent futures, monthly chart

Source: tradingview.com

According to Tradingview data, the Brent price might get pumped during an upcoming month. There are three reasons for that:

Short term period:

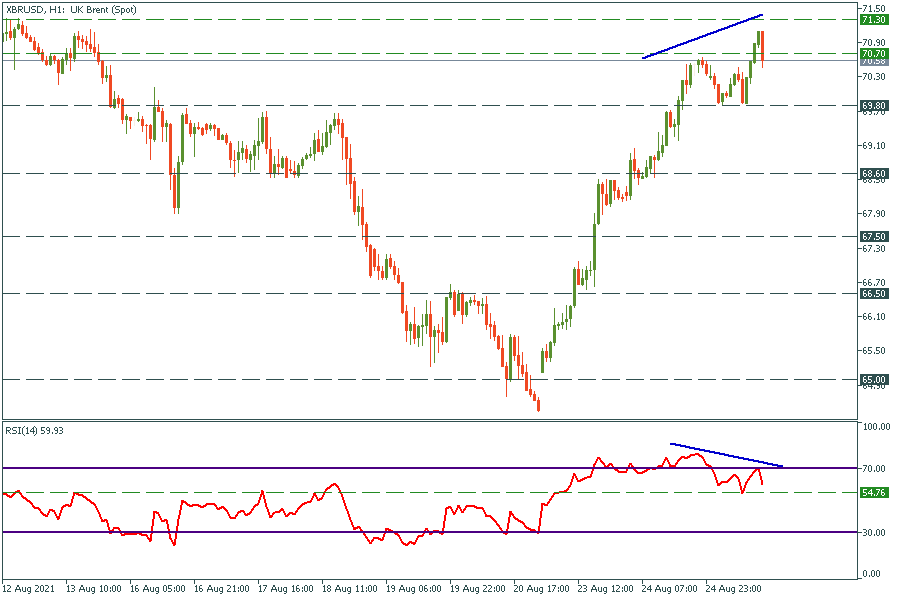

XBR/USD, 1H chart

On the 1 hour chart, the bearish divergence occurred. The closest support level is $69.8. If the price breaks through, it will drop to $68.6. Otherwise, we might see the price reaches $71.3 and the main August target of $72 shortly.