Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal area

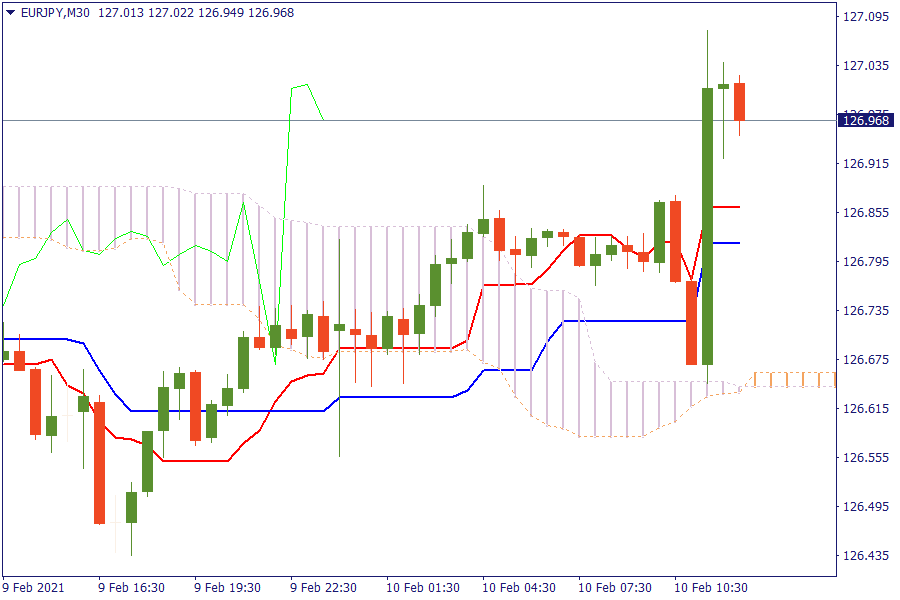

EUR/JPY: The pair is trading above the cloud. An upward pressure would lead the pair to exit further the cloud, confirming a bullish outlook.

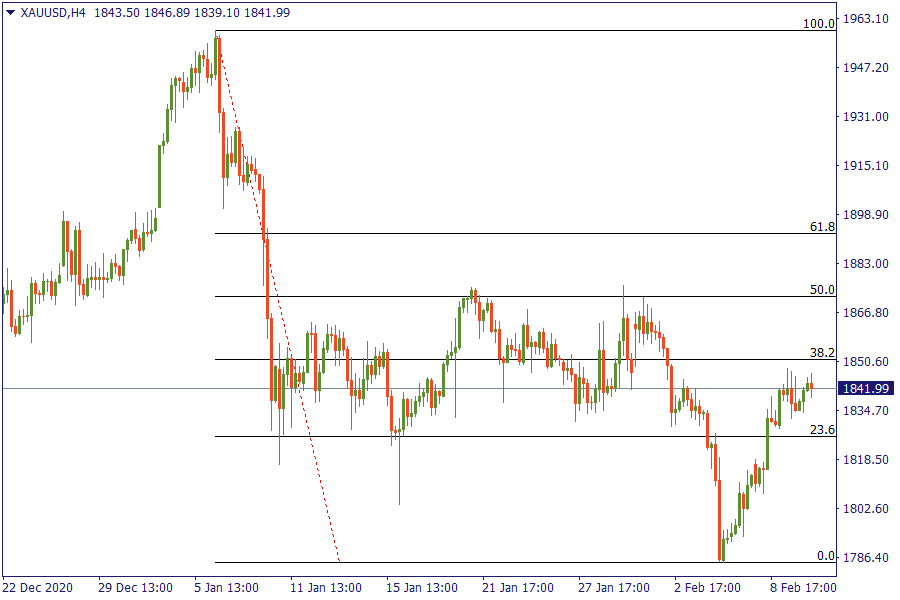

XAU/USD: Gold after further weakness is trading below 38.2% retracement area. Bulls show signs of resistance.

World shares rose to new all-time highs overnight, and European indexes strengthened, with market sentiment generally upbeat on the prospect of fiscal stimulus and vaccine rollouts and ahead of a speech by U.S. Federal Reserve Chair Jerome Powell. U.S. President Joe Biden said on Tuesday he agreed with a proposal by Democratic lawmakers that would limit or phase out stimulus payments to higher-income individuals as part of his $1.9 trillion COVID-19 relief bill.

China's consumer price index fell more than expected, but factory prices posted their first year-on-year rise in 12 months, suggesting gathering momentum in the industrial sector. up. Chinese stocks rose to multi-year highs on the last trading day before the week-long lunar new year holidays.

The U.S. government will begin shipping COVID-19 vaccines directly to community health centres next week, as part of Biden's goal of administering 100 million doses of the vaccine in his first 100 days in office. U.S. Federal Reserve Chair Jerome Powell will speak in a webinar about the state of the U.S. labour market at 19:00 GMT.

EUR/USD has been holding gains above 1.21, as the dollar remains on the back foot. Investors remain upbeat about US fiscal stimulus while shrugging off Europe's slow vaccination campaign. US inflation and Fed Chair Powell's speech are awaited.