Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaOn Thursday, September 23, shares of Carnival had jumped a solid 3% after the cruise line announced it is on track to have 50% of its fleet sailing again by October, and 65% by the end of the year. So what? Read the article to find out!

The company said its "gradual, phased-in approach" using what it called enhanced protocols, vaccinated cruises, and updated testing and masking policies will enable it to conduct sailings from major ports around the world, including the U.S., Mexico, the Caribbean, the U.K., Western Europe, and the Mediterranean. If to compare this with other major cruise companies, Carnival is the first and the only one to announce that it is back in the game.

Third-quarter 2021 ended with $7.8B of free cash in the company, which the company believes is sufficient to return to full cruise operations. Voyages for the third quarter of 2021 were cash flow positive and the company expects this to continue. As of August 31, 2021, eight of the company's nine brands have resumed guest operations as part of its gradual return to service. Booking volumes for all future cruises during the third quarter of 2021 were higher than booking volumes during the first quarter of 2021, albeit not as robust as the second quarter of 2021, primarily as a result of lower booking volumes in August 2021, reflecting the impact on overall U.S. consumer confidence resulting from heightened uncertainty around the COVID-19 Delta variant.

Not all the news is good, however. Yesterday, the company announced that two of the brands that will hit 50% capacity in October, Princess and P&O, will be extending their pause in operations out of Australia because of ongoing coronavirus restrictions in that country. Carnival currently doesn't expect to resume cruising out of Australia until about mid-January for most cruises.

Regardless, most analysts are predicting that if Carnival keeps to its schedule for restarting the other cruises, the company will turn profitable again as early as next year. Analysts forecast $0.22 per share in profit for Carnival in 2022, valuing the stock at 110 times forward earnings.

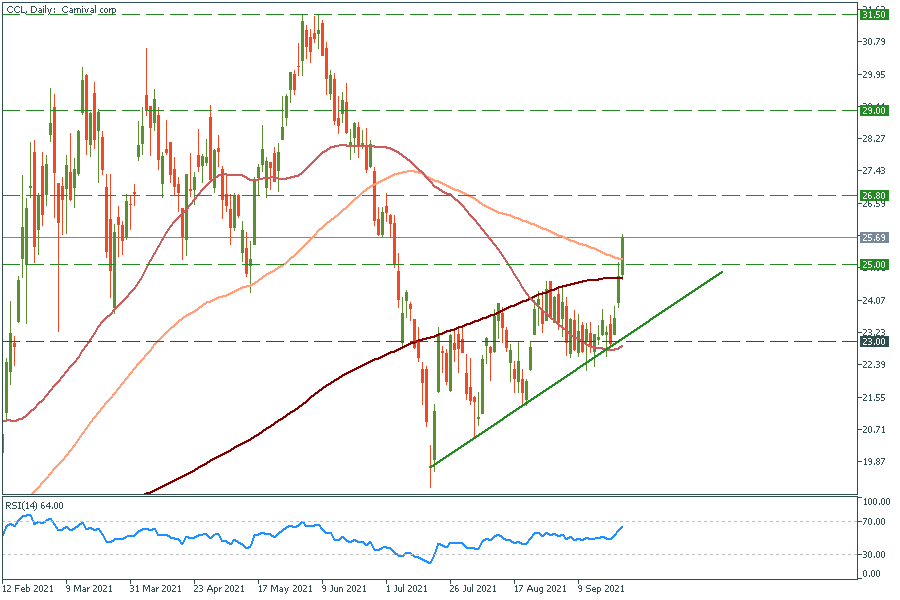

As for the chart, CCL is rushing through the consolidation and looking bullish. Just imagine, now this is the only company to start the cruises after 1.5 years of delay. The prospects are amazing!

Carnival daily chart

Resistance: 26.8; 29.0; 31.5

Support:25.0