Trading Accounts

Trading Conditions

Financials

Trading Instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThe hypothesis laid out here is that in the crypto environment, there are also polarities like stable assets and risky assets, similar to the traditional financial environment. It doesn’t matter how risky Bitcoin or any other asset is in relation to the US dollar or any other traditional asset. What matters is how risky or stable are the digital currencies in relation to one another – and this is how you need to treat them. Here are some examples to examine this hypothesis.

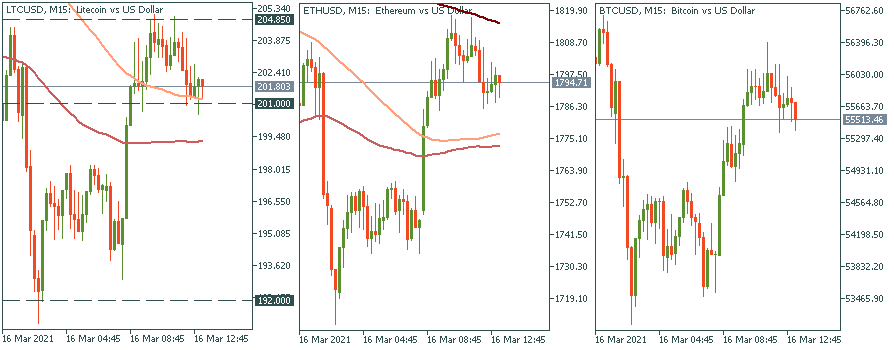

Below, you have three charts: Litecoin, Ether, and Bitcoin respectively. As you can see, they are almost identical. Therefore, it is reasonable to assume that in the eyes of global traders, they have a very similar risk profile, if not identical.

BTC, ETH, and LTC have very similar trajectories most of the time

You may rightly say that Bitcoin – as well as any other digital asset – is considered a highly risky asset in comparison with the US dollar or other fiat currencies. That will be true. However, you have to treat the digital world as somewhat separate from the traditional one and compare Bitcoin (or, similarly, Litecoin) not to the US dollar or the Euro but to other digital currencies. Such as Ripple for example.

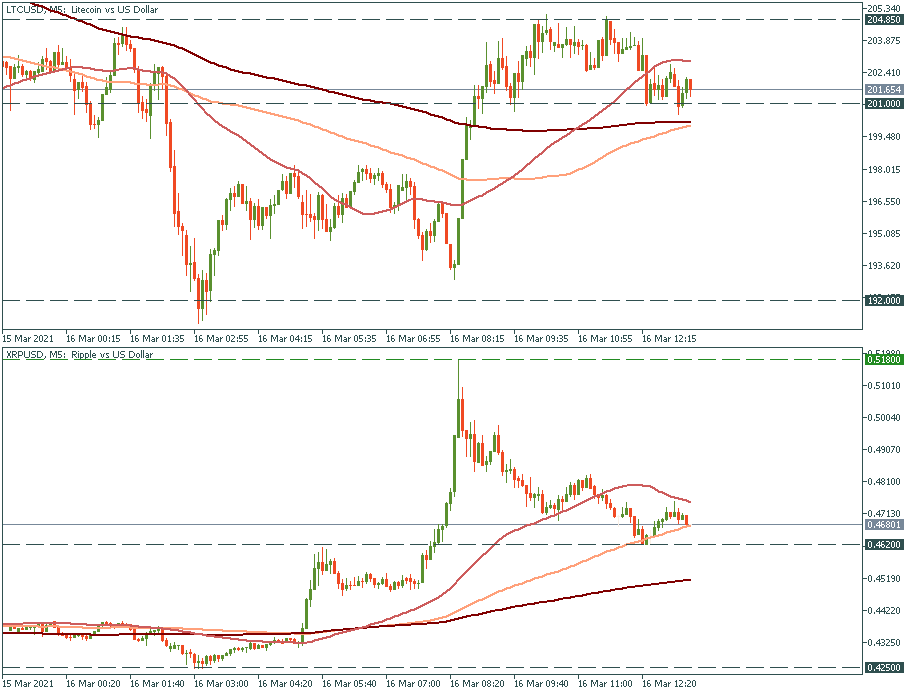

Have a look at the M5 chart below. It is obvious that if Litecoin and Ripple are not inversely related all the time, they definitely belong to different classes of assets in the crypto universe. While Litecoing was trembling and pressed above the support of 192, Ripple did a rocket-launcher leap from 0.4250 to 0.5180 gaining more than 10% in an hour. Then, as soon as its upward march stopped and bears took over, Litecoin shot from above 192 to 205.45 to eventually stabilize at 201. Roughly, it seems like a 75% inverse correlation. This is one of the clues for you to trade the crypto assets.

Ripple appears to be much more volatile and inversely correlated to BTC, ETH, and LTC