Trading Accounts

Trading Conditions

Financials

Trading Instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaOPEC+ meeting last week was concluded with the following results:

The decision was rather unexpected. While some of the cartel’s members (Russia) were known for pushing to roll back oil supply, most of the other members were believed to follow a conservative and cautious course of Saudi Arabia. The latter advised it’s time to “test” the market and review results on April 28 when the next meeting is scheduled.

However, while the OPEC’s decision was a result of inner compromise rather than a true belief in the confident demand recovery, observers are not pessimistic on the latter. Therefore, the upside is still a possible projection area for the oil price.

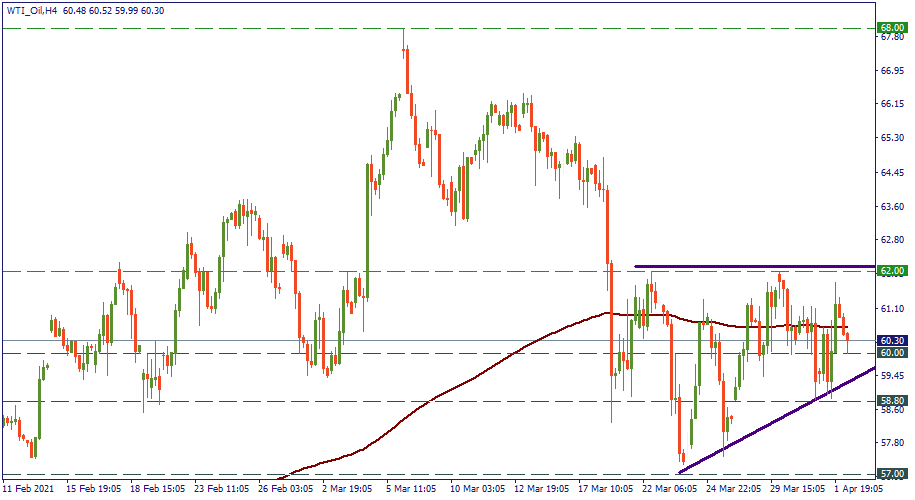

Currently, WTI oil is fluctuating around $60. After it reached $68 at the beginning of March, it never came back. Moreover, it lost more than $10 of value dropping to $57 later on. Since then, higher lows have been forming suggesting that the downward correction may be over. As the technical pattern of the triangle indicates, sideways movement may extend through the middle of April until bulls come back to take over and break the resistance of $62.