Trading Accounts

Trading Conditions

Financials

Trading Instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaSince the beginning of the week, Brent lost 6%. It was caused by several factors, which are described in this article. Let’s discuss them and find out how will oil price move during upcoming OPEC-JMMC meetings!

Data out of China shows that factory activity growth declined in July, which is the first time in over a year. Also, 46 cities have been locked down in China due to the COVID-19 pandemic. This fact concerns investors as China, the largest oil consumer in the world, might reduce the demand as its economic growth slows.

The ISM Manufacturing index of national factory activity fell in July. Data released by Automatic Data Processing, the payroll company, revealed that although the private sector added 330,000 jobs in July, that is less than experts predicted (653000 jobs) and less than half the number of jobs added in June. Moreover, the Energy Information Administration reported that crude oil stockpiles increased last week, though gasoline inventories fell. Experts suggest that oil stockpiles increase was caused by export drop but not domestic demand.

In this case, traders should pay attention to export numbers, as falling export can signal worldwide demand decrease.

OPEC’s oil production hits the largest numbers since April 2020. In July 2021, the organization decided to increase output by 400000 barrels daily and plans to increase it monthly at the same number through April 2022. This could affect world supply as coronavirus lockdowns return.

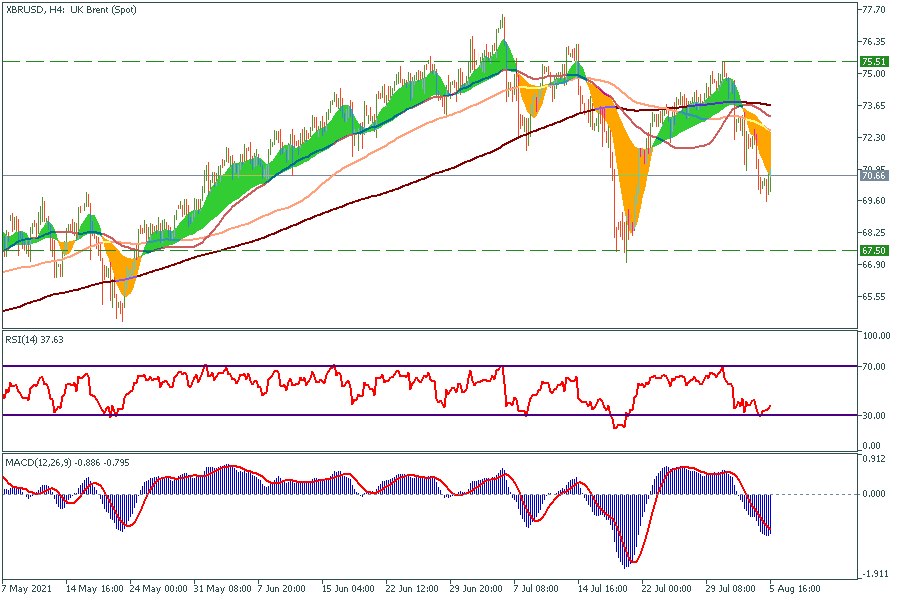

4h Chart

At the moment, $67.5 is the main support level. Until Brent's price is higher than $67.5 uptrend is going to continue. The RSI and MACD show that the price is going to reverse soon and go up to $75.5. If Brent breaks this resistance, the next target will be $80.

Fundamentally, trend reversal could be caused by news from India. The data shows that gasoline demand grew by 646000 BPD in July, despite India’s second place in coronavirus cases. This country imports almost all the crude oil it needs.