Trading Accounts

Trading Conditions

Financials

Trading Instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

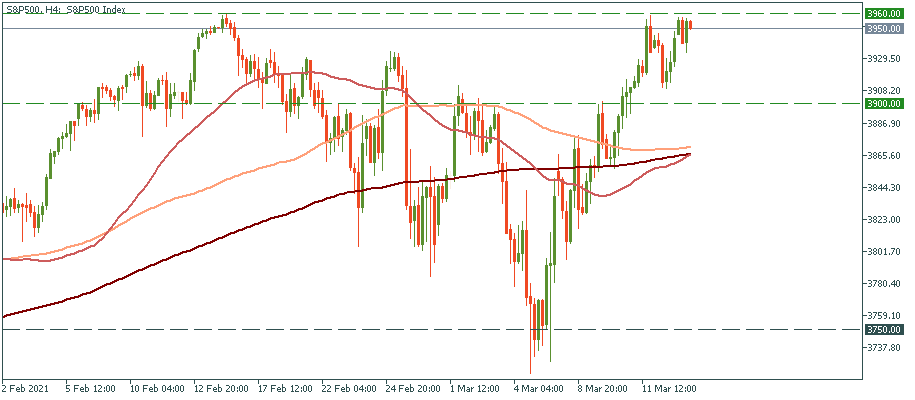

Personal area3960 is an all-time high and a four-week high for the S&P. The index is challenging this resistance currently, and it’s not yet clear whether it’s going to cross it or will bounce downwards instead. Very likely, it will hang in there for a while as the first bullish attempt to cross it was reversed forcing the S&P to drop to above 3900. That means bulls don’t have enough momentum to make a one-leap march towards 4000 – optimism needs more time to move the index through to the next all-time high.

Fundamentally, Apple is on the brink of opening a whole new market for itself. As it’s marching into the EV-production industry together with Hyundai-KIA, millions and billions of sales profits are just around the corner for the IT-giant. That said, currently, it trades at local lows of $116. Together, both statements make this stock a potentially very worthy buy right now.

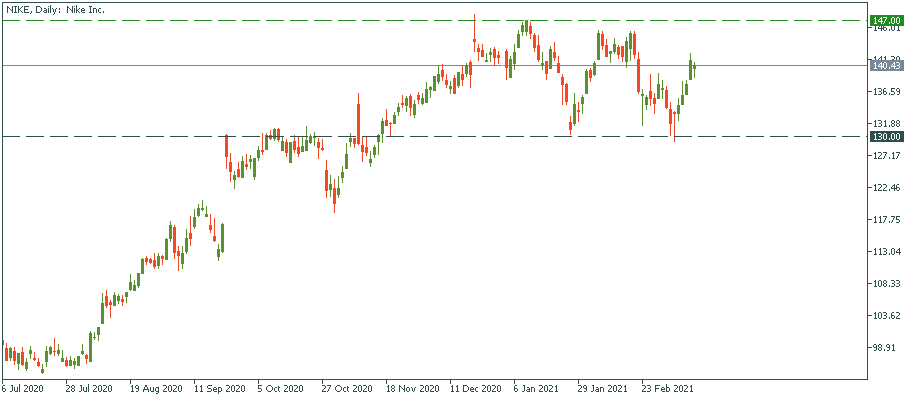

Nike is at its all-time highs. Although it ceded the gains dropping a few dollars from the mark of $147, strategically, it’s around the highest point it has ever traded. On Thursday, it will report its quarterly earnings for the fiscal quarter ending February 2021. If the figures are impressive – which they very likely are, given that the reported quarter includes holiday season – the stock will likely make a break through the current resistance to make a new all-time high. Therefore, it potentially present a very handy buy opportunity.

The famous EV-maker has a couple of problems now. First, there was a fire at one of the plants. It was put way, obviously, but sometimes, we get a feeling that important fundamentals are not properly addressed in Tesla business, don’t we? Second, one of Tesla investors sued Elon Musk for violating the SEC settlement with one of his tweets. Not just one, in fact – most of them are pretty vague – but the one suggesting that Tesla stock was “too high” particularly made investors worry about the shrinking value of the stock resulting from the tweet. Finally, upbeat economic outlook presses on growth stocks like Tesla indirectly through higher rates and yields. Therefore, the local stop at the round resistance of $700 makes Tesla quite suspicious. Wait a while and give it some time to act more decisively before you make a decision to open a position on it. However, if an uptrend starts forming, it may result to be a very impressive gain: from the current $700 to $900, it's more than 25% of potential rise.