Trading Accounts

Trading Conditions

Financials

Trading Instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThe third full week of April is expected to be relatively quiet on Forex - with a few exceptions. Primarily, it will be the Reserve Bank of New Zealand that announces its Cash Rate on Wednesday – that may create shifts in NZD/USD and other pairs with NZD. Also, Australian labor authorities will announce the Employment Change and Unemployment Rate – some upbeat data may push AUD. Other than that, no major events are planned for the Forex week. In the meantime, the stock market is opening the earnings reports season – that’s the prime time for stock market movers. The US corporate landscape may be experiencing turbulence through the middle of the next month. Therefore, fasten your seatbelts, and prepare to see your stocks moving in MT5 and FBS Trader.

Remember you can trade stocks in FBS Trader!

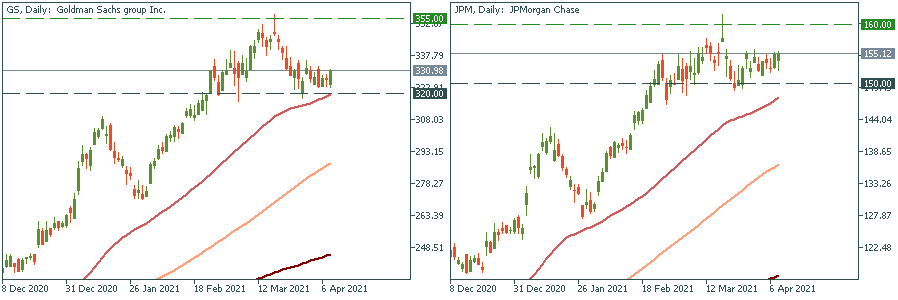

Reporting: April 14, 12:30 and 11:30 MT time respectively.

These major banks will release their earnings on Wednesday before the US market open. Both brought strong financial performance results in the previous quarter, and the market is not expecting any less than that this time. Both stocks are now slightly below the recently made all-time highs and will likely beat them if the outlook is optimistic.

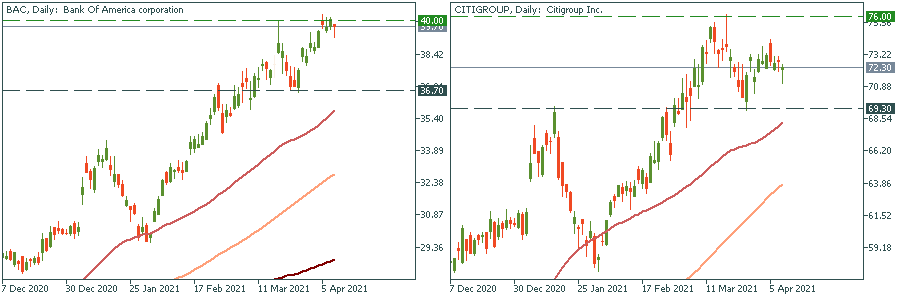

Reporting: April 15, 13:00 and 14:00 MT time respectively.

Another couple of the largest US banks, these two are notably different in their stock price performance. While BAC has been pretty bullish lately – probably, the most bullish among all the banks – and its stock has been busy making a new all-time high, Citigroup has not yet reached the pre-virus levels. That’s why the release of the earnings report may be crucial for Citi to possibly form a stronger uptrend. That is, if investors are satisfied with the results on Thursday.

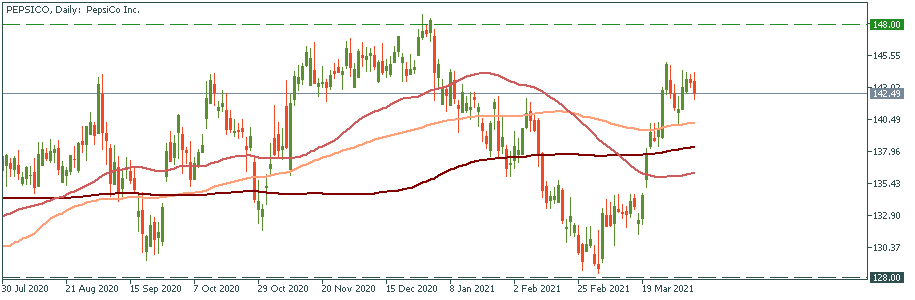

Reporting: April 15, 12:15 MT time.

PepsiCo releases its earnings report on Thursday, too. Its stock price performance has been notably turbulent, with a clear resistance in the area of $145-147: this was the pre-virus all-time high that was challenged only once since the virus kicked in. In December, the stock price moved up and even inched above it but then plunged to $130 – another key level that has been supporting the stock price all along since May. Currently, Pepsico stock is very close to the resistance area again. Therefore, a strong earnings report may finally push it through to new all-time highs.

Reporting: April 27, 12:00 MT time.

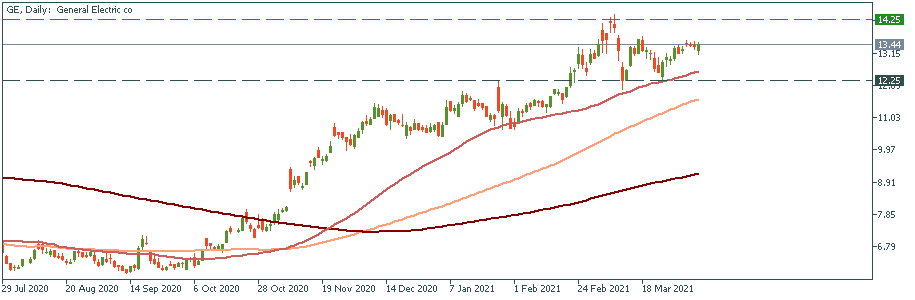

This stock’s performance has been quite peculiar: it was going flat until the very end of 2020 where it suddenly took off to currently trade slightly above the pre-virus high that corresponds to an important level of 2018. Beating that level and moving into the upside may start a whole new strategic uptrend for General Electric which has done a lot to restructure its financial layout and make investors happy.