Trading Accounts

Trading Conditions

Financials

Trading Instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThis Wednesday, the US Fed announces the interest rate and the monetary policy report.

In terms of the rate itself, no change is expected until the year 2023 – the rate will be held steady at 0.25%. The question is what happens in 2023. In this regard, there are two camps: optimists (they maintain that there are grounds to plan for rate hike in 2023) and “cautionists” (they abstain from affirming that there is certainty to increase the rate).

What are the factors in favor of the US economic optimism?

In fact, that’s the only fundamental factor, and it’s pretty inconclusive as “strong” is a very relative quality prone to change quickly with time. Largely, it is based on the same optimism that see a rate hike as the most likely scenario in 2023.

What are the factors against the US economic optimism?

Therefore, it is, basically, optimism (hopes) against realism (facts and figures). As the US Fed’s Chair Jerome Power is known for clinging to the latter, most observers believe that the coming Fed’s announcement is not going to provide much new information or interpretation of the US economic status - therefore, no major change of perspective is expected.

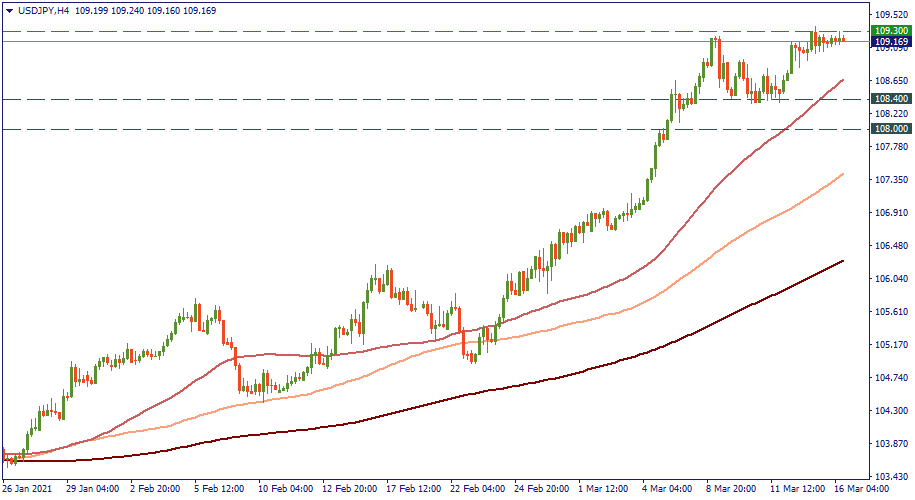

In such a neutral atmosphere, any subtle tone in the Fed’s commentary may move the USD in either direction. For example, the USD has been strong on the JPY lately, and hawkish outlook will support that strength lifting it to 109.50 and above. Alternatively, a dovish stance may bring it down to lower supports such as 108.00.