Trading Accounts

Trading Conditions

Financials

Trading Instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThe Central Bank of the Republic of Turkey (CBRT) raised its cash rate, surprising investors. It was a necessary action for Turkey to meet the bank's target of lowering inflation to 9.4% by year-end to approach the longer-term target of 5% in 2023.

"It is crucial that the lira offers a sufficiently attractive carry trade to appreciate in the coming months, or at the bare minimum to be relatively stable against the dollar," says Rabobank.

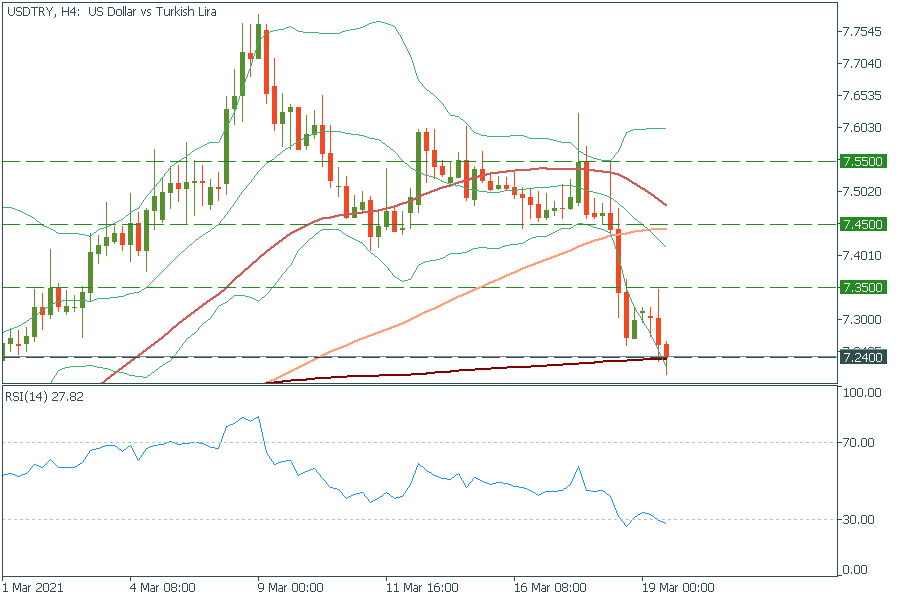

USD/TRY plunged as the Turkish lira rose against the US dollar after the Turkish bank’s decision. In fact, the TRY was one of the few currencies, that have managed to strengthen against the greenback on an intraday basis.

USD/TRY dropped to the 200-period moving average at 7.2400, which also lies on the lower line of Bollinger Bands. The RSI indicator went below the 30.00 level, indicating the pair is oversold. Thus, the pullback should happen soon. The move above yesterday’s high of 7.3500 will drive the pair to the 100-period moving average of 7.4500. Just in case, support levels are 7.2400 and 7.1400.