Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaCoca-Cola reports its quarterly earnings for the first quarter of 2021 on April 19, 12:30 MT time.

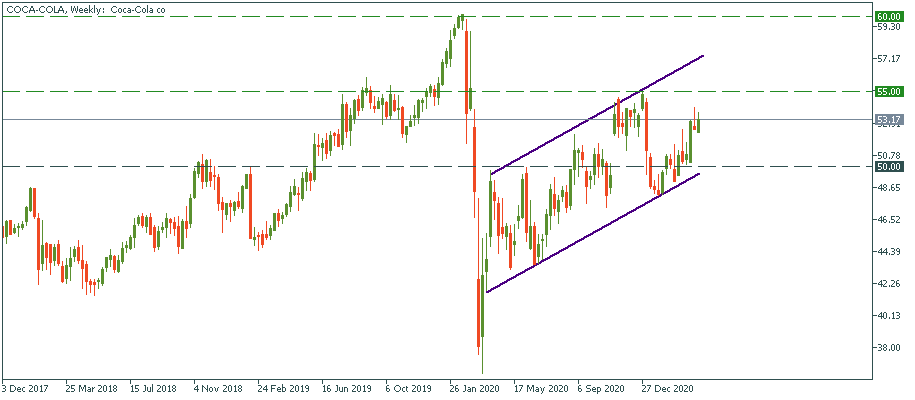

Coca-Cola’s stock hasn’t recovered from the virus hit. From the current level it trades at, it has more than 10% of potential value growth to surpass its last all-time high of $60. Will it make it? Let’s look at the fundamentals.

Don't forget Coca-Cola stock is available in FBS Trader!

Strategically, the main factor on the side of Coca-Cola is its history-proven robustness and vastness of the business. It has survived 135 years in operation, and will likely survive as much. Therefore, for long-term trading, it’s ideal. Now, what about the mid-term and short-term – perspectives that are most useful to trade the coming quarterly report?

In 2019, there was an indication of a very strong demand for the company products that pushed its sales 6%. In 2020, as most of the revenue used to come from outside venues that got closed under virus restrictions, sales fell 9%. The first quarter of 2021, however, is when the reopening process started unrolling in most parts of the globe. Therefore, while it’s pretty difficult to predict that the actuals figures will be for Q1’2021, they will be very indicative of the dynamic that may set the trend for the entire year.

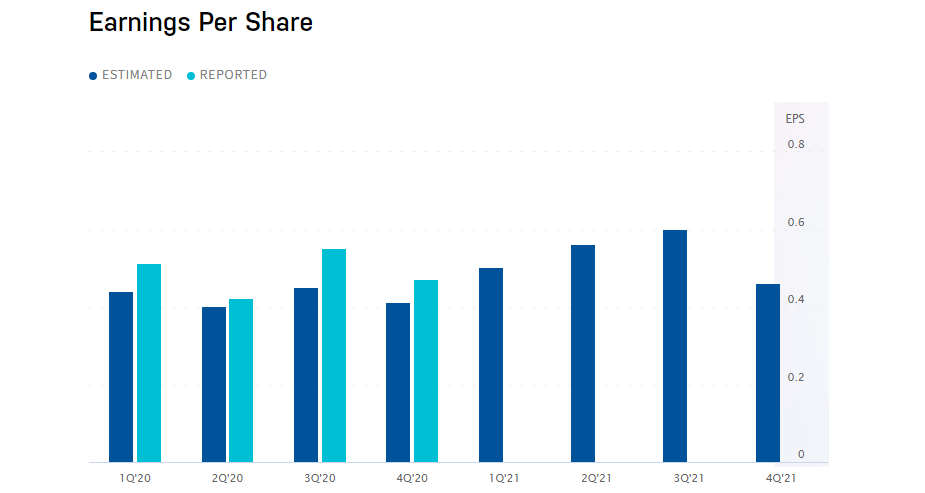

So far, Coca-Cola’s dividend yield is 3.2% which is way more than the S&P 500’s 1.5%. During the entire 2020, it's been consistently beating the EPS expectations against all odds of the virus-torn business environment. The expected EPS for Q1'2021 is $0.5.

Source: nasdaq.com

During the previous quarter’s earnings report, Coca-Cola's CFO expressed confidence that the performance of 2021 will be equally good or stronger than that of 2019. That makes the stock price of $60 adn the EPS of $0.5 a very achievable target - if the report confirms that statement and possibly beats the market’s expectations.