Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

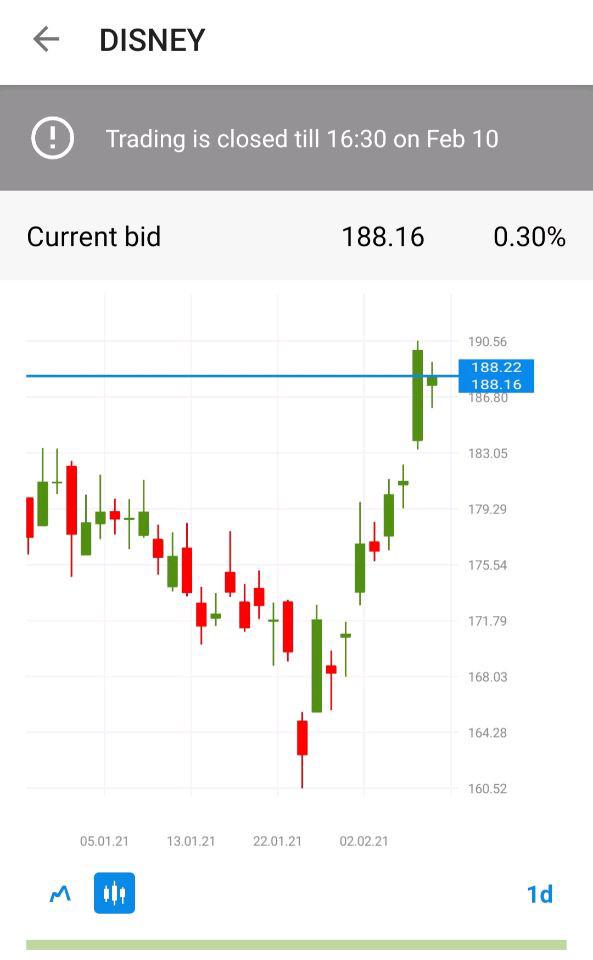

Personal areaWalt Disney hit the all-time high on Monday. Investors are waiting for the next catalyst to drive the stock further up. It won’t take too long as this Thursday Disney reports its earnings at 23:30 MT time (GMT+2). Analysts are expecting $15.89 billion in sales and -$0.33 loss per share.

If the actual results are greater than the market estimate, Disney may reach new records.

In the opposite scenario, if results come out worse than anticipated, Disney will drop.

The Covid-19 pandemic hit hard the House of Mouse as the company was forced to shut down its shops and Disneylands amid lockdowns and thus lost a lot of its customers. Disney tried to join the overall digitalization with its streaming platform Disney+, which should help to offset the losses. Actually, the streaming platform has nearly 90 million subscribers now.

Disney has been trading in an uptrend since February. If earnings come better, the stock will have a chance to rise to the key psychological mark of $200.00. On the flip side, the move below the low of February 3 at $176.00 will press the price down to the next support of $168.00.

Remember that stock trading starts as the US session begins (at 16:30 MT time).

Don't know how to trade stocks? Here are some simple steps.