Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

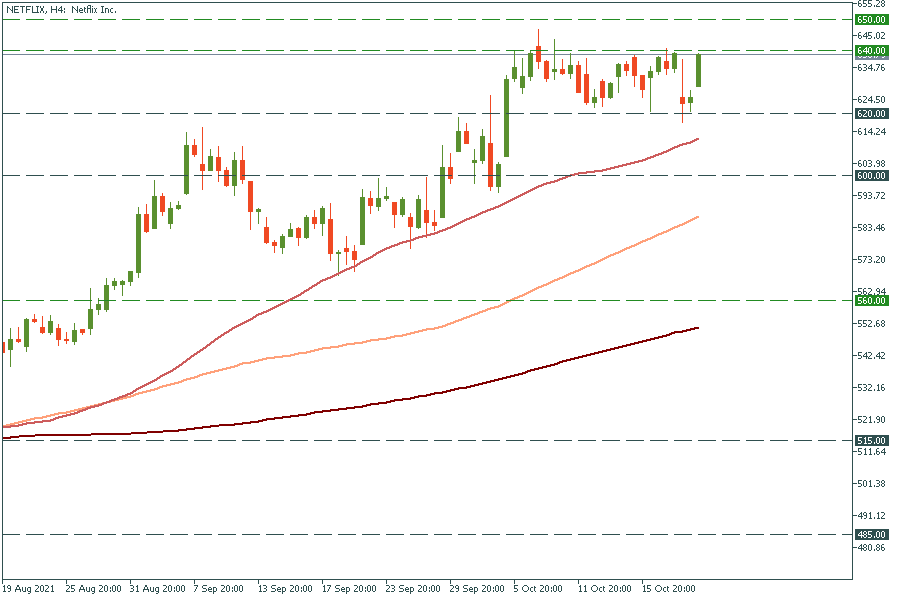

Personal areaNetflix published better-than-expected earnings results for the third quarter and also surprised investors with the huge subscriber growth due to the popular "Squid Game". Netflix added 4.38 million subscribers, while Wall Street analysts forecasted 3.86 million. Wow! However, the market reaction was mixed. Yesterday's session finished in a goalless draw: nor bears neither bulls took control. The candlestick closed with no shadow, which means the opening and closing prices were equal.

Why did Netflix drop on good results?

In short, ‘buy the rumor – sell the fact’. All investors knew that the “Squid Game” has astonishing popularity, that’s why they were expecting good results from the company and priced in the good outcome well ahead of the release. When the actual number was known, the stock fell.

If Netflix breaks above the resistance level of $640.00, it will rocket to $650.00 – the next psychological mark. Support levels are $620.00 – the recent lows and the psychological level of $600.00.

Tesla has reported better-than-expected earnings results for the third quarter. EPS: $1.86 vs the forecast of $1.52. Notably, the report marked the 9th quarter of profit in a row. Earlier, Tesla announced it delivered 241,300 electric vehicles globally in the third quarter, which was Tesla’s record number for quarterly deliveries.

The Tesla stock tends to rally (look at the long green candles at the chart below) ahead of the earnings releases but then drops when the actual numbers are known. Thus, today, the stock can fall in the short term. However, it is going to gain from such good results in the long term as it showed investors that it is doing its business great.

Tesla was rallying so rapidly as it even broke the upper line of the channel. Now it has broken the resistance level of $880.00. Thus, it can rocket to the psychological mark of $900.00. The support is at $850.00.

The pharma giant Johnson & Johnson published earnings that beat analyst expectations, sending its price soaring (look at the long green candle in the chart). The Covid-19 remains the main threat, that’s why JNJ is likely to gain in the 4th quarter due to its vaccine. Besides, the Food and Drug Administration authorized Covid-19 vaccine booster shots made by Johnson & Johnson, which is really great for Johnson & Johnson.

The stock price of JNJ has failed to cross the resistance zone of $165.00-166.00 (the 200-day MA and the 38.2% Fibo level) and reversed down. It has broken below the support level of $163.00 (the 23.6% Fibo level). It may fall to the psychological mark of $160.00.

Don't know how to trade stocks? Here are some simple steps.