Trading Accounts

Trading Conditions

Financials

Trading Instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaAs you know, technical analysts rely on the past of the price to predict its future. Some traders try to prove this way of trading to be wrong and unprofitable. But we want to show you the Ross Hook, the pattern, that is proven to be profitable for 32 years already.

The Ross Hook (RH) trading strategy is a 100% price action strategy based on the retest of 1-2-3 pattern breakout. If you haven’t read about the 1-2-3 reversal pattern, be sure to check it out first!

Also, I must warn you, if you are new in trading, trying to find a ross hook pattern on your chart may be quite difficult at first. Why? Because you need to identify 1-2-3 pattern correctly, and after that wait for Hook to emerge. That can be confusing at first but I’m sure you can deal with it!

I don’t want you to get confused here because RH pattern is really useful, so I’ll explain everything as simply as I can. Look at the ordinary 1-2-3 pattern, and then at the Ross Hook.

Now, look closely at the RH.

Do you see it? The Ross Hook is just a smaller 1-2-3 pattern that is formed after the bigger one!

Now, everything you need to do is to find this “double 1-2-3 pattern” (that’s not an official name, but simplicity is the key).

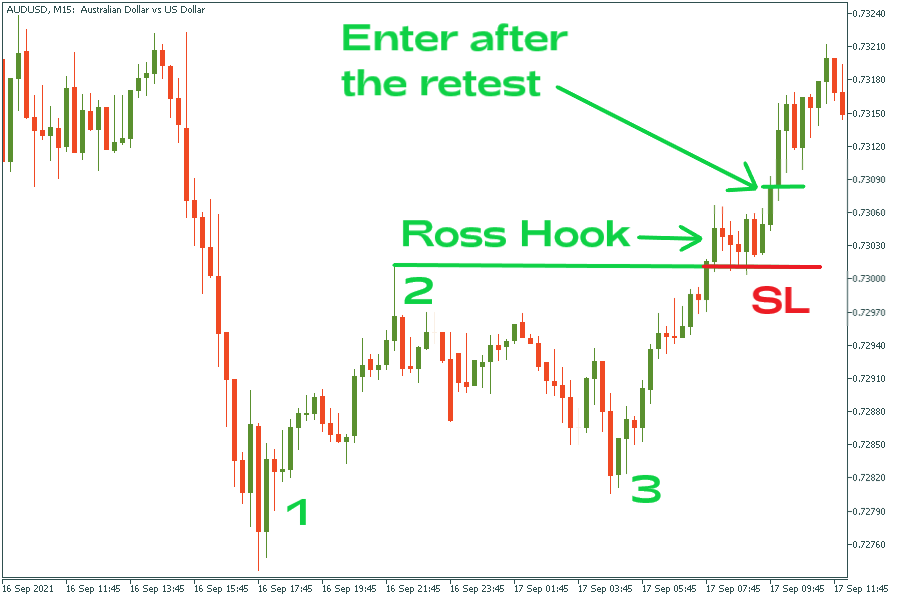

To trade the RH pattern, we need to follow several steps:

Look at the picture to get it right. We have waited for the 1-2-3 pattern to emerge, then we opened a trade after the retest and put stop loss (SL) below the retest level.

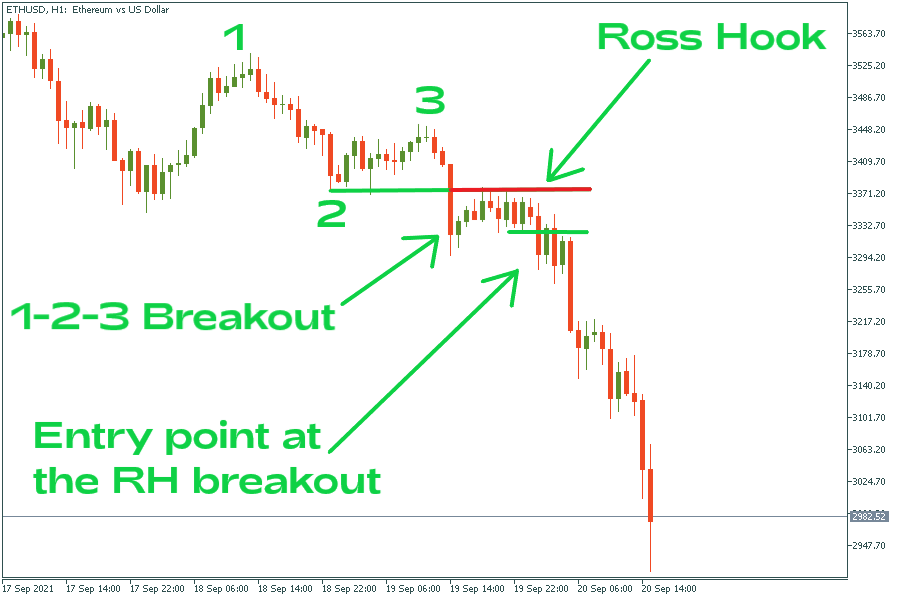

Now, let’s analyze a short trade:

We have identified a pattern, waited for Ross Hook to form, and entered after the retest.

You can measure your take profit differently:

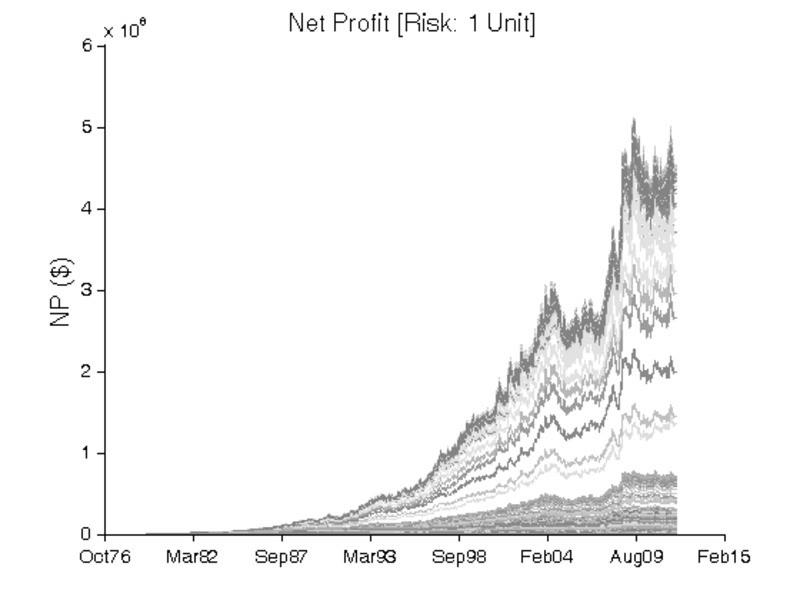

First of all, I want to prove the usability of the pattern. Analysts from Oxford University have tested this strategy on 42 different assets (including forex pairs, futures, and stocks) over 32 year period. Starting with $1 million and having a risk of 1% per trade the strategy has proven to be profitable. If you have traded with this strategy, you would have made more than $5 million net profit.

Let’s sum up:

Pros:

Cons: