Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal area

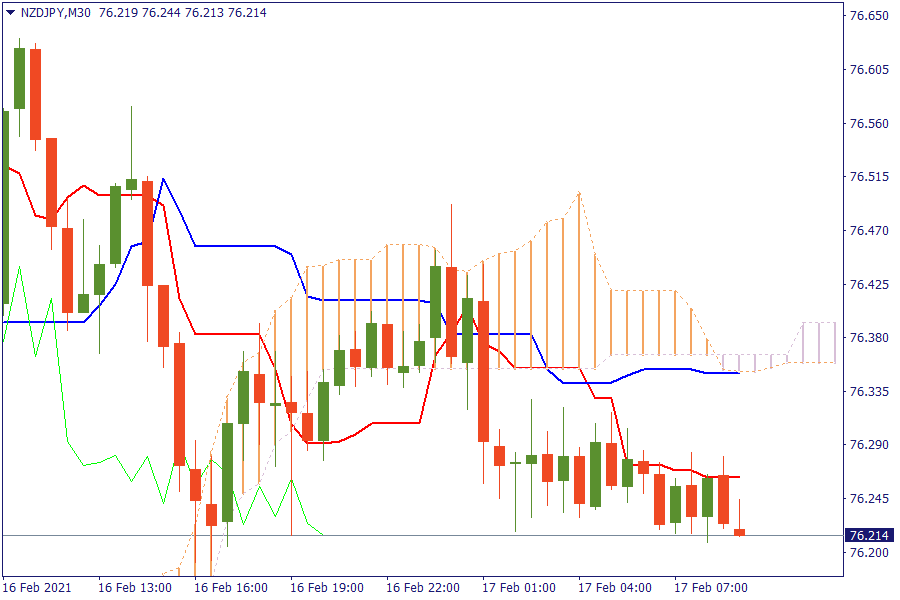

NZD/JPY: The pair is trading below the cloud. A downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

XAG/USD: Silver continuous to stand below the 38.2% retracement area. The bearish pressure is growing.

Asia-Pac equity markets traded mostly lower after the lackluster handover from Wall Street. WTI crude futures hovered around the USD 60/bbl level. The winter storm stateside is said to have hit US oil output by as much as a third. Overnight on Wall Street, the Dow Jones was helped to a record closing high by gains from banks, which benefit from higher yields.

US Treasury yields hit one-year highs on Wednesday, lending support to the dollar but pressuring lofty valuations for stocks, as investors reckoned that a stimulus-fuelled global recovery will eventually bring rising inflation. The gap over two-year yields also opened to its highest level in nearly three years, as traders figure that short-term monetary policy will stay supportive, even as the world bounces back from the pandemic.

The dollar gains against low-yielding currencies on Wednesday, hitting a five-month high against the yen as US bond yields jumped on the prospects of further economic recovery.

Looking ahead, highlights from the macroeconomic calendar include UK CPI, Retail Sales, Industrial Production, Canadian CPI, FOMC Minutes, Fed's Rosengren, Kaplan, BoE's Ramsden speeches.