Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal area

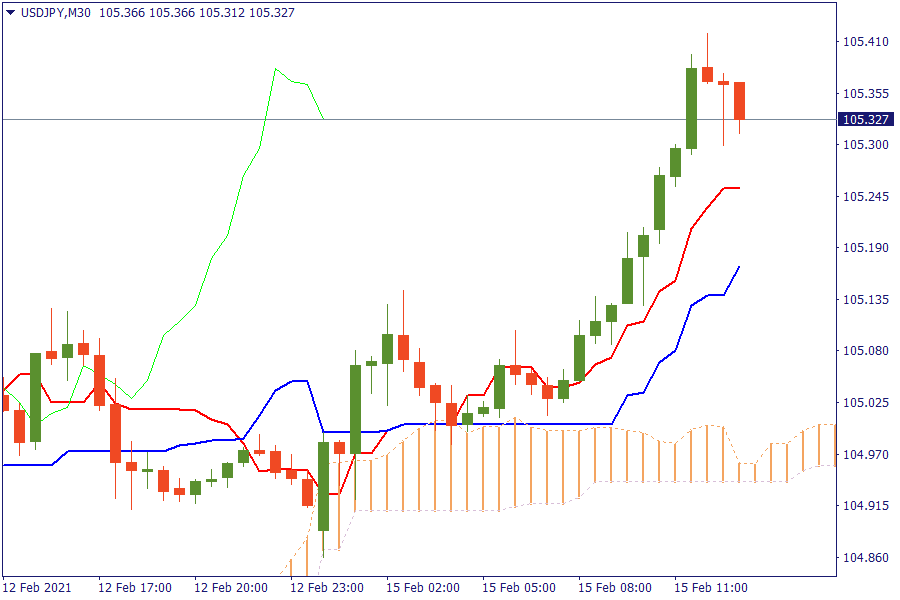

USD/JPY: The pair is trading above the cloud. An upward pressure would lead the pair to exit further the cloud, confirming a bullish outlook.

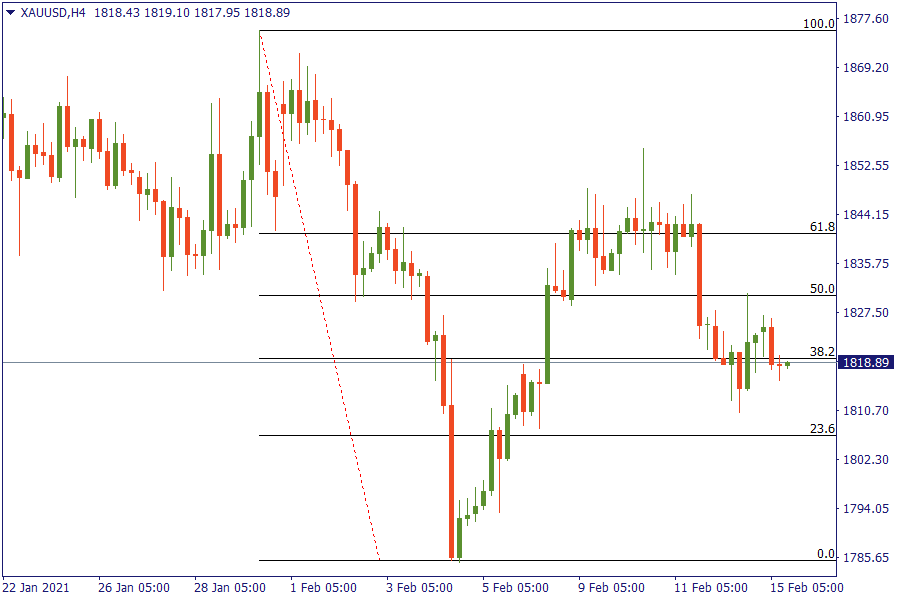

XAU/USD: Gold after further weakness is trading below the 38.2% retracement area while silver gains.

Global shares rose for the 11th day in a row to reach a peak on optimism about the rollout of COVID-19 vaccines and new fiscal aid from Washington, while tensions in the Middle East drove oil to a 13-month high. As more people are vaccinated across key markets such as the United States, and with US President Joe Biden looking to pump an extra $1.9 trillion in stimulus into the economy, the so-called reflation trade has gathered steam in recent days.

Oil prices soared on Monday to their highest in about 13 months as vaccine promised to revive demand and producers kept supply high. Russian Deputy Prime Minister Alexander Novak supported that the global oil market is on a recovery path and the oil price this year could average $45-$60 per barrel.