Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal area4H Chart

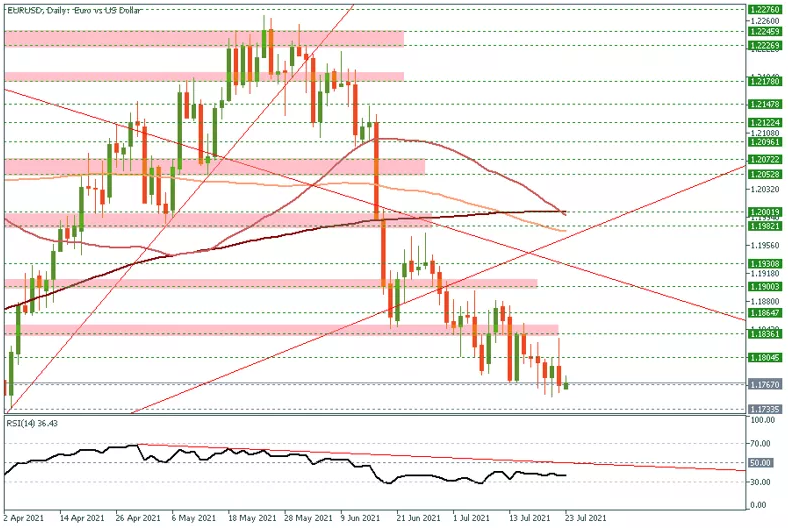

Daily Chart

EUR/USD managed to rise for a very short period of time right after the ECB decision to as high as 1.1798 before declining and giving away its entire gains. The ECB decided to keep the current policy unchanged as widely expected, but President Christine Lagarde stressed that the ECB has learned from the history and will not be tightening early, sending a clear message to the market that tapering discussions won’t happen any times soon. EUR/USD declined following these remarks but remained well above its 1.1760 which should be watched carefully as the technical indicators are still near the oversold area, suggesting another leg higher before the downside trend resumes. Therefore, I would risk some EUR/USD longs at the current levels at 1.1760 with a tight stop of 1.1720 with an initial target of 1.18 followed by 1.1830.

|

S3 |

S2 |

S1 |

Pivot |

R1 |

R2 |

R3 |

|

1.1640 |

1.1713 |

1.1742 |

1.1786 |

1.1815 |

1.1859 |

1.1932 |