Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaWall Street analysts are the most bullish on stocks in almost two decades. About 56% of them recommend buying S&P500 stocks. It is the largest indicator value since 2002. Such bullish sentiment was caused by the highly successful earnings season.

Analysts are gaining optimism as the stock market gains continuously and companies outperform even the highest expectations. The Q2 earnings season was one of the strongest in history. At the moment, it looks like neither Delta variant COVID cases growth, nor China’s regulator crackdown are able to change traders’ sentiment as S&P500 doubled since March 2020 dump.

Analysts are bullish not only towards the US stock market, in Europe and Asia the number of bullish predictions reached 10-year heights.

Analysts predict S&P500 12% growth and 21% HK50 growth within 12 months.

However, traders shouldn’t lose control over their trading strategies as the market moves in whatever direction hurts the most participants. This bullish sentiment combined with a risk of inflation growth can play a bad joke on everyone.

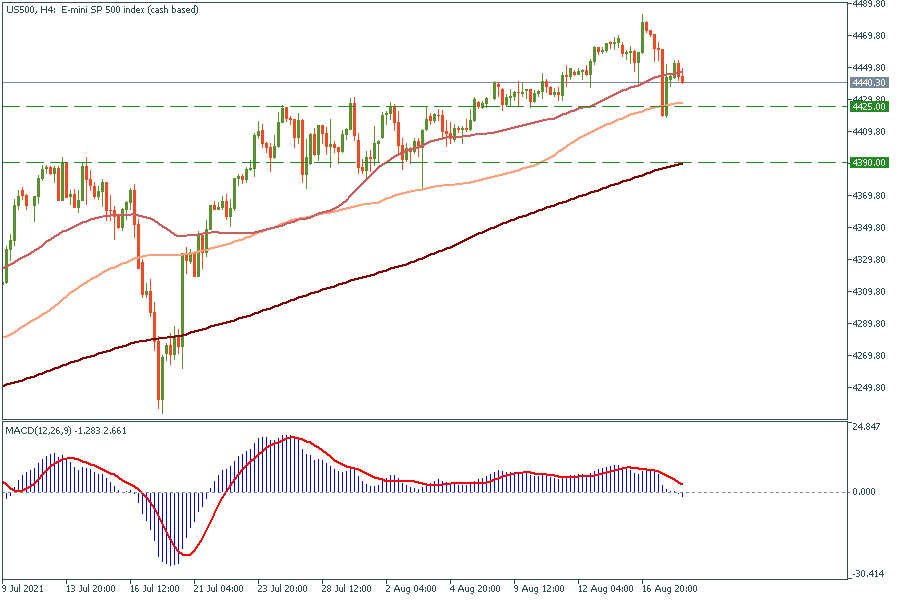

4H Chart

At the moment, S&P500 is heading towards the 100-period moving average. If the price breaks this support through, the next target will be 4390, which will be a good buy option as in this case the price will locate near the bottom line of the channel S&P500 have been moving into since March 2020.