Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaPepsiCo will publish its financial results for the first quarter of this year on April 15 at 13:00 MT.

PepsiCo’s earnings report will impact hugely the stock price.

Not great, but good enough! Its soda sales stayed in positive territory despite the weak demand at restaurants amid the long lockdowns. In comparison, Coca-Cola's sales dropped. Besides, the beverage giant is not just Pepsi – it produces many other products such as snack foods, including well-known brands as Lays, Doritos, ad Cheetos (far more than Coca-Cola). However, sales growth is still relatively flat.

Anyway, PepsiCo is viewed as one of the safest companies in its sector and most reliable dividend companies. With almost 50 years of dividend growth history, PepsiCo will soon become a dividend king!

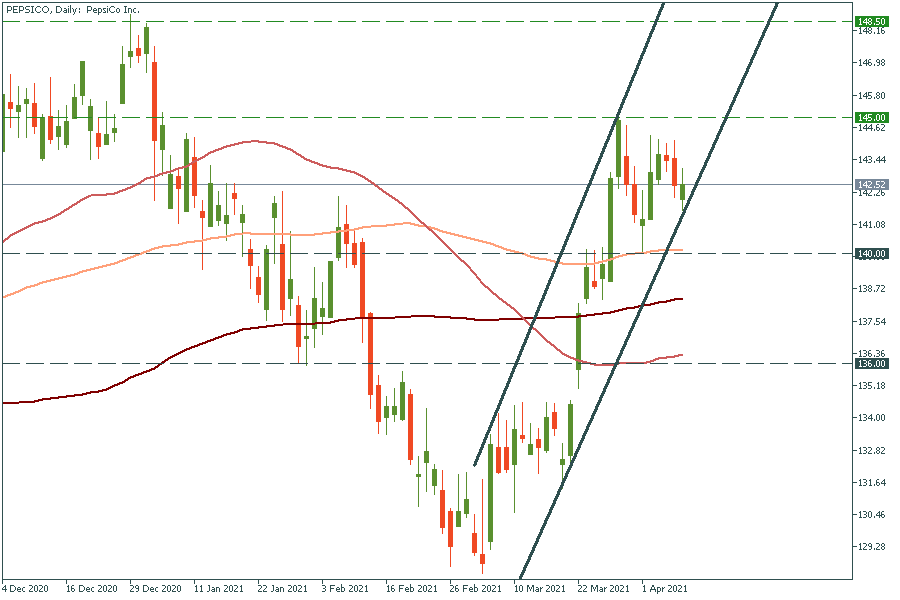

PepsiCo has been moving inside the ascending channel since March. If it manages to break the high of March 29 at $145.00, it will rally up further to the all-time high of $148.50, which the company hit in December. On the flip side, if PepsiCo’s earnings are worse than the forecast, it may press the price down below the 100-day moving average of $140.00. If it drops below it, it may even fall to the 50-day moving average of $136.00.

Don't know how to trade stocks? Here are some simple steps.