Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaStablecoins are a new class of cryptocurrencies that attempts to offer price stability and is backed by a reserve asset. Stablecoins have gained traction as they attempt to offer the best of both worlds—the instant processing and security or privacy of payments of cryptocurrencies, and the volatility-free stable valuations of fiat currencies (good old USD). Like all cryptocurrencies, stablecoins are based on a blockchain – decentralized database that stores the information in a specific way. Blockchain makes it possible not to rely on one data center because every transaction and a ledger itself is stored on every node (point of intersection) of the network.

While bitcoin remains the most popular cryptocurrency, it tends to suffer from high volatility in its valuations. For instance, it rose from $30000 to $58000 between January 27 and February 21, 2021, and fell from $64650 to $29100 between April 14 and May 19, 2021. It is inconvenient to make payments with such a volatile instrument. Instead of it, stablecoins offer a way less volatile solution. Collateralized by real-life assets, they are reminiscent of fiat currencies, which are pegged to an underlying asset such as forex reserves.

Even in certain extreme cases when a fiat currency’s valuations move drastically, the controlling authorities jump in and manage the demand and supply of currency to maintain price stability. Stablecoins are here to help all cryptocurrency users find an island of stability at the time of volatility.

1. Stablecoins Backed by Commodity

Stablecoins that are pegged against commodities generally have the backing of hard assets for stability. The hard assets could include real estate or gold. However, the most used hard asset for collateralization of stablecoins is gold, with many stablecoins using a diversified collection of precious metals. Some of the examples for such tokens are Tether Gold and Palladium Coin.

2. Stablecoins Backed by Crypto Assets

Crypto-collateralized stablecoins are backed by other cryptocurrencies. Since the reserve cryptocurrency may also be prone to high volatility, such stablecoins are “over-collateralized”—that is, a larger number of cryptocurrency tokens is maintained as a reserve for issuing a lower number of stablecoins. For example, $2,000 worth of Ether may be held as reserves for issuing $1,000 worth of crypto-backed stablecoins which accommodates for up to 50% of swings in reserve currency (Ether).

3. Stablecoins Backed by Fiat Currency

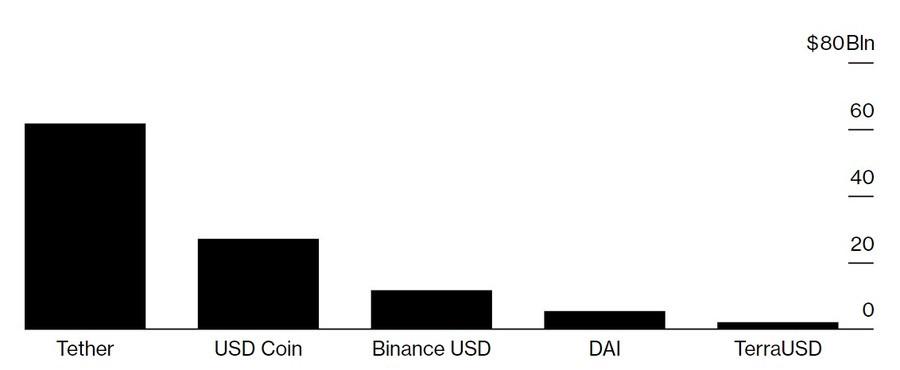

Fiat-collateralized stablecoins maintain a fiat currency reserve, like the U.S. dollar, as collateral to issue a suitable number of crypto coins. They are extremely popular, mainly because they are considered to be a printing machine of the cryptocurrency economy and because they provide stability in eternally volatile markets. To comply with strict regulating regulatory requirements, they need to undergo an audit procedure. The most popular fiat-collateralized cryptocurrencies in the world are Tether (USDT), USD Coin (USDC), and Binance USD (BUSD), with a total capitalization of over $100 billion.

4. Algorithmic stablecoins (Seigniorage).

Algorithmic stablecoins use algorithms to automatically increase or decrease digital currency reserves like real-life monetary supplies’ managers do. There are mostly gone due to regulations.

5. Central banks digital currency (CBDCs).

CBDCs are digital currencies backed by a government’s central bank. They are a form of state-backed currency, just like a banknote. They are backed by states, not corporations, or, in the case of Bitcoin, the blockchain. Since they are tied to a state’s currency, CBDCs will fluctuate along with the traditional currency. Most models of CBDCs are fully regulated under a central authority. China was the first country to test launch the Chinese Yuan as CBDCs in February 2021. In crypto community they aren’t in favor due to 100% centralization and absence of anonymity.

Tether or USDT is the biggest and most popular stablecoin with an overall market capitalization of more than $62 billion!

Source: https://www.bloomberg.com/news/articles/2021-07-26/tether-executives-said-to-face-criminal-probe-into-bank-fraud?sref=qgDWnyMx

Tether was specifically designed to build the necessary bridge between fiat currencies and cryptocurrencies and offer stability, transparency, and minimal transaction charges to users. It is pegged against the U.S. dollar and maintains a 1-to-1 ratio with the U.S. dollar in terms of value.

On the other hand, Tether has a drawback. Tether has been accused of a lack of transparency and discrepancies in its collateralized reserves. The US SEC was suing Tether, saying that the company doesn’t have enough USD to collateralize every issued USDT. However, accounting firm Moore Cayman attested an "assets and liabilities" report from Tether in February. As of February 28, 2021, Tether held more than 100% of assets to back the issuance of fiat and commodity-backed stablecoins. The US didn’t stop there and after six months the Justice Department asked for reserves confirmation. On August 9, 2021, Tether released another assurance report, once again confirming that their reserves are fully backed.

With FBS you will be able to trade cryptocurrency in pairs with USDT. It is reliable, fast, and popular.

Probably the biggest stablecoins risk is centralization. Stablecoins must be collateralized with some asset, you can’t just mine it like a Bitcoin or earn as a reward for being an active member of the network. Therefore, even though this is still cryptocurrency, and all transactions are visible to everyone, irreversible and safe, the issuing of new tokens is in the hands of few. Some people were accusing stablecoins issuers of pumping the cryptocurrency market with constant tokens printing.

Cryptocurrency is young and ambitious finance industry with rapid growth and constantly emerging opportunities. Make sure you will not miss the train!

Stand by for more articles about the cryptocurrency industry, and trade with FBS!

Don't know how to trade cryptocurrencies? Here are some simple steps.