Trading Accounts

Trading Conditions

Financials

Trading Instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThe Bank of England will present a monetary policy statement on Thursday, August 4 at 14:00 MT (GMT+3).

Experts and analysts are confident about the future of UK monetary policy. The market expects the Bank's Monetary Policy Committee (MPC) to vote unanimously to keep the bank rate at 0.10% and the target stock of asset purchases at £895BN.

At the same time, there are several opinions about UK’s currency reaction to the statement. The community is concerned about domestic and global Covid trends which will also determine the direction of the UK currency. The absence of consensus amongst analysts as to how the pound will react might be a signal of an upcoming high volatility period.

The number of new COVID-19 cases was decreasing over the past week. The average of daily new cases dropped to 424 from 702 on July 21. This fact can make consumers and businesses feel positive about the economy’s recovery and rejuvenate that strong economic growth seen earlier in the second quarter.

GBP/USD 4H chart

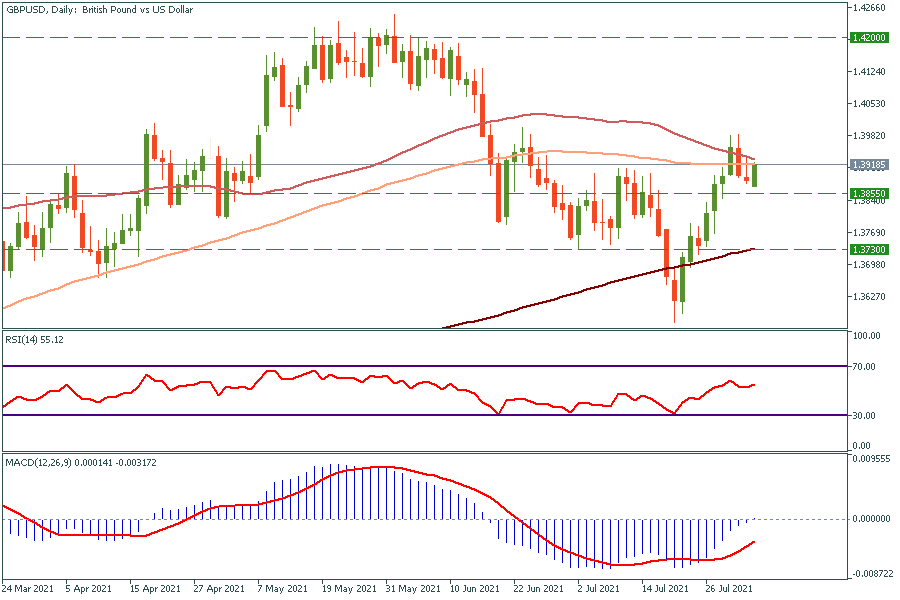

GBP/USD Daily chart

At the moment, the price is trying to break through the crosspoint of 50 and 100-day moving average. If it breaks through, the target will be $1.42. Otherwise, it might cross $1.3855 support and drop down to $1.373, which is the 200-daily moving average.

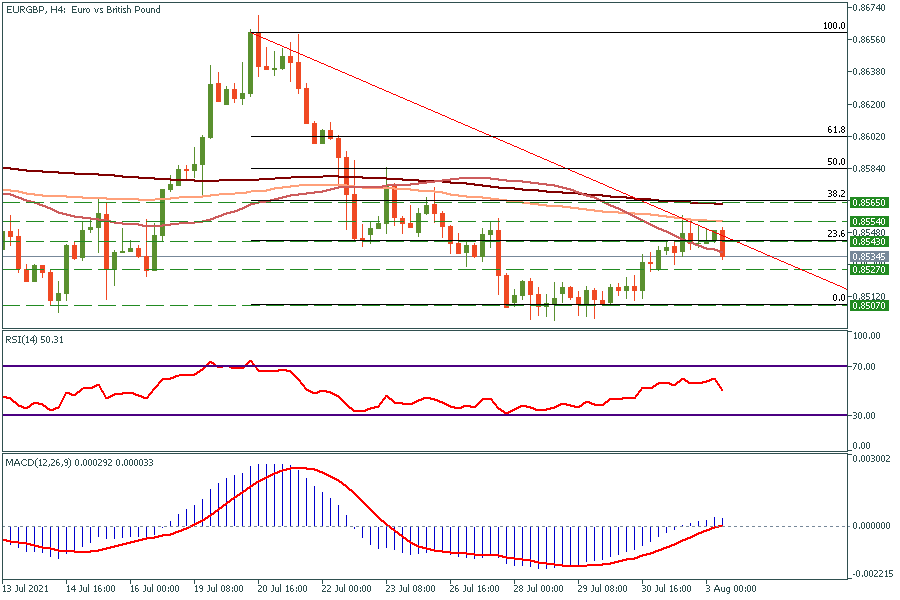

EUR/GBP 4H chart

At the moment, the price is trying to break the 50-period moving average. If it does and sticks under the line, the target will be 0.8507. Otherwise, it will turn around and move towards 0.8543 (23.6 Fibonacci), 0.8554 (the 100-period moving average), and 0.8565 (the crosspoint of the 200-period moving average and 38.2 Fibonacci) support lines.