Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaLet’s look at what the GBP’s doing today and put things in perspective.

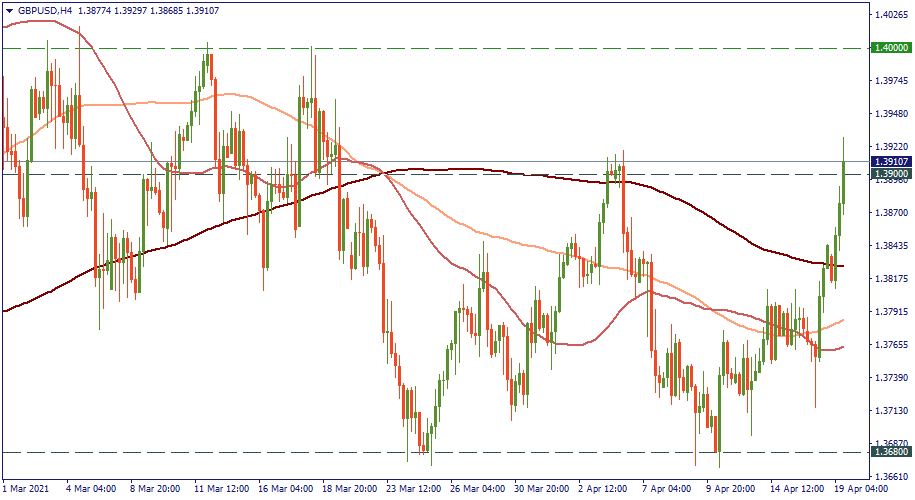

Against the USD, it’s testing the four-week high of 1.39. Technically, it’s already above that level but there is little reason to expect that the pair firmly established itself in that zone. The primary reason for the move of the GBP/USD is the weakness of the USD – not the strength of the pound, and the reason for that weakness is of temporary nature related to the US Treasuries. That’s why traders should expect volatility and a rather quick comeback from the USD. Therefore, looking for reversal short-term patterns to expect a following downswing in the GBP/USD would probably be an appropriate scenario.

On a long-term view, EUR/GBP is completing a tip and going back to fall to 0.85. Currently, the zone where EUR/GBP trades corresponds to the February highs. Recovering the losses in March, EUR/GBP went upwards to touch the zone 0.87-0.8720, and very possibly, that may be the end of the upswing. Therefore, for a mid-term and long-term trading strategy, expecting a drop to 0.85 in the coming weeks seems a very reasonable scenario as the British pound remains considerably strong across the board.