Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

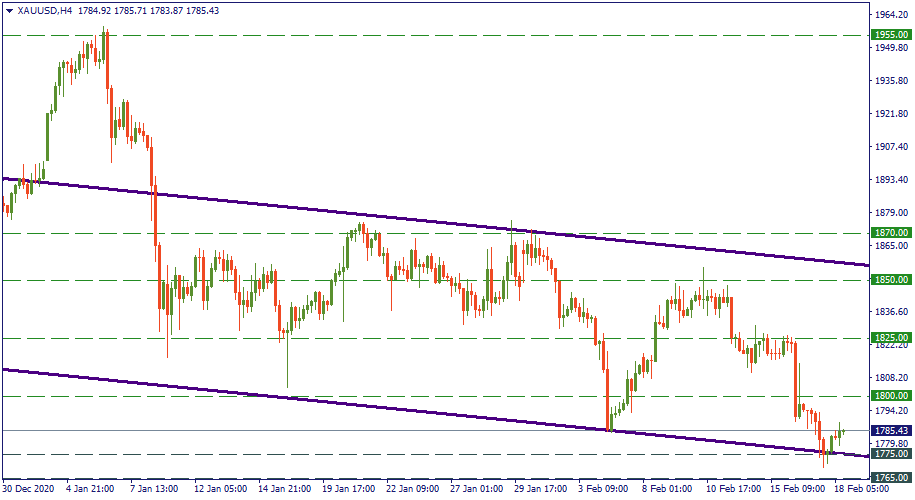

Personal areaGold has been going down since August. From the high of 2 070, it eventually dropped to 1 765 in November. After, it rose to 1 955 – the second time since autumn - which created a suspicion that a bullish trend change may happen. Never happened. Just in several days, gold plunged to 1 845 and crossed the support of 1 800 – that’s what we’ve been observing recently.

Strategically, the support of 1 765 is an important indicator of the bearish power behind the current downtrend. If it gets crossed, we’ll have a solid confirmation that the market doesn’t find any serious reason to keep gold above 1 800. In this case, if 1 765 gets crossed, 1 700 may result to be a very possible target for bears in the coming weeks.

In the short-term, we are still waiting to confirm whether the large downtrend will continue or not. So far, 1 765 is still the secondary support; the primary is 1 775. Now, if the price bounces downwards from the local resistance of 1 800 where it’s aiming now, that may be the start of the downswing that would drag gold to cross the November lows of 1 865. Otherwise, If 1 800 gets crossed to the upside, there will be a higher likelihood to see a bullish takeover of the large panorama.