Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

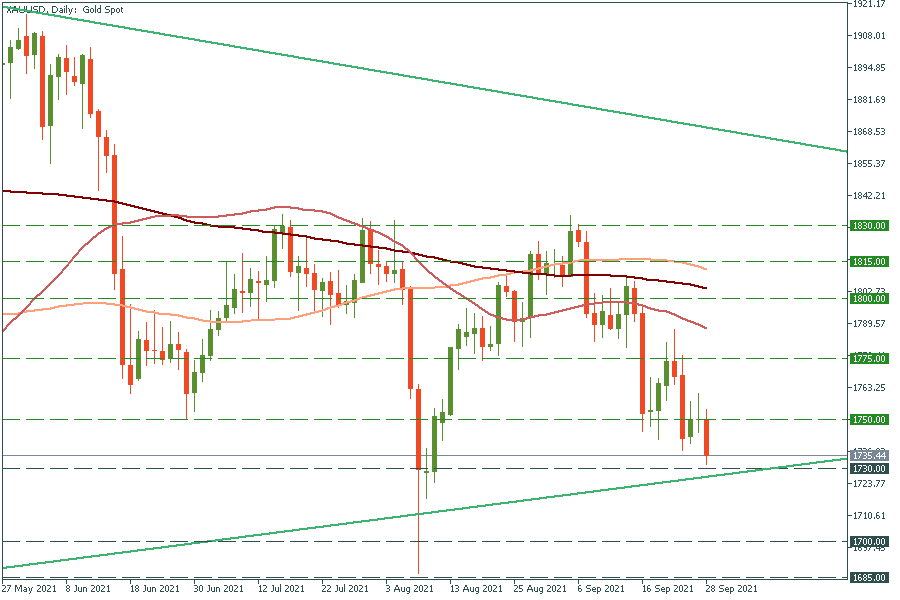

Personal areaInvestors have favored gold at the start of the week due to the worries over China’s Evergrande debt crisis. As we know, the yellow metal tends to rise in times of market instability. However, the growth has stopped fast due to the strong US dollar (gold and the USD have an inverse relation). The greenback gained as traders expect the Federal Reserve to hike rates earlier than initially thought. Indeed, the US central bank has started talking in a more hawkish manner. As a result, the USD is likely to keep rising and gold – falling.

XAU/USD has formed a symmetrical triangle pattern. The lower line of the triangle intersects with the support level of $1730 – the low of August 9. If it breaks below this support line, it will mean that gold escapes the triangle, so the way down to the psychological mark of $1700 will be open. In the opposite scenario, if gold reverses up from the $1730 level, it may jump to $1750 – the recent high.