Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

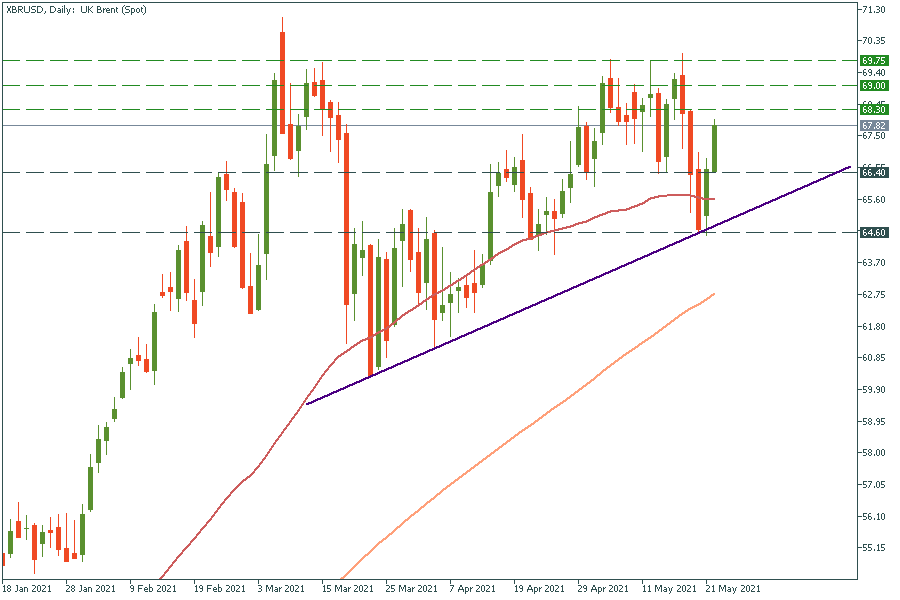

Personal areaDespite the lack of demand in the oil market in recent months, Goldman Sachs expects the oil prices to go higher amid global economies’ stabilization and a rise of mobility across the world. After major economies eased their lockdown restrictions, the price of Brent has climbed from the lows around $50 in January to almost $70. The price of WTI followed a similar path, rising from $50 to $65 per barrel since the start of the year.

The analysts of Goldman Sachs are confident about restoring demand in the oil market. According to them, 75% of the demand recovery will come from developed economies and China. Vaccination progress will be the key factor supporting the oil prices. Another positive trigger for oil prices is connected with the expansion of international travel.

The main risk for the rising oil prices is related to the possible restoring of oil production from Iran. The country is in the process of reviving the 2015 nuclear deal right now. If the deal is successfully reached, the United States will lift sanctions on Iran’s oil, boosting the supply of the black gold. However, a three-month monitoring deal between Iran and the U.N. nuclear watchdog had expired last week and limited access to images from Iranian nuclear sites. This pause has provided a boost to the oil prices on Monday. All in all, analysts are sure that even if the deal is reached and provides the recovery in Iranian production in 2022, the OPEC+ will take action and halt its 500 thousand barrels/day production increase in the second half of 2021. As a result, reaching $80 in this kind of scenario seems highly possible.

The price of Brent has risen to $68.3 following the news of the pause in negotiations between Iran and the US. The first resistance for Brent lies at $68.3. To pull the price of Brent lower, bears need to drag it below $66.4 to $64.60.