Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThe Federal Reserve left the policy unchanged yesterday and signaled that it wouldn’t be ready to tighten the policy anytime soon. After that meeting, the USD dropped and EUR/USD rocketed to the two-months high.

Today, the pair has already reversed down as the demand for the greenback resurged. Fresh worries over the increase in coronavirus cases in India are worsening the market sentiment and therefore supporting the safe-haven US dollar.

Besides, the USA will publish its Advance GDP growth at 15:30 MT (GMT+3), which is widely expected to beat forecasts. If the data is really stronger-than-expected, the USD will get another stimulus to rise and EUR/USD will fall. Nevertheless, in the long term, EUR/USD is likely to move higher as the focus will shift to the European economic recovery.

According to Westpac, “EUR/USD looks set to remain in the upper half of its 1.17-1.22 range, but is likely to struggle towards range resistance.”

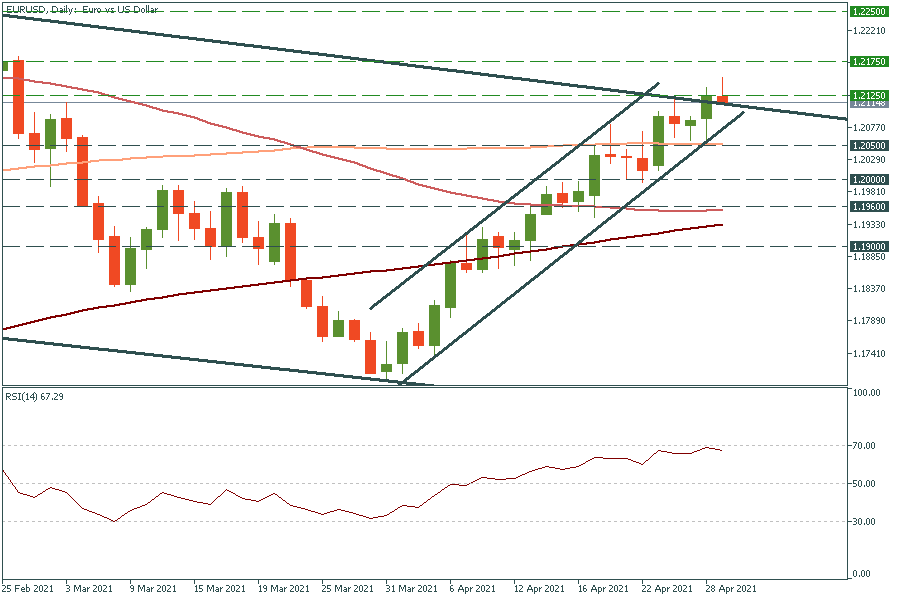

In the long term, EUR/USD is moving in a downtrend, while in the short term, it’s trending up. After breaking the upper trend line, the pair reversed down as the RSI indicator came closer to 70.00, signaling the pair is overbought. It may fall to the 100-day moving average of 1.2050, but it’s unlikely to break this level on the first try as it’s strong support, which the pair has failed to cross several times. So, this decline should be just a correction ahead of the further rally up. If it bounces off the 1.2050 mark, on the way up it will meet resistance levels at yesterday’s high of 1.2125 and the high of February 25 at 1.2175.