Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaFOMC press conference is among the primary methods the Fed uses to communicate with investors regarding monetary policy. It covers in detail the factors that affected the most recent interest rate and other policy decisions, along with commentary about economic conditions such as the future growth outlook and inflation. Most importantly, it provides clues regarding future monetary policy.

Today, on September 22, traders await FOMC’s tapering decision as it will make a huge impact on the markets. In this article let’s discuss two possible variants of the FOMC statement and imagine how they will affect the market.

US dollar index daily chart

In the 1st scenario, the US dollar index will drop down to 92.3 support level, in case, of breakout the next target will be 91.5. USD/*** will fall. ***/USD will rise.

In the 2nd scenario, the US dollar index will surge to 93.7 and 94.4 resistance levels. USD/*** will rise. ***/USD will fall.

Gold (XAU/USD) daily chart

In the 1st scenario, XAU/USD will surge with the main target at $1839.

In the 2nd scenario, XAU/USD might drop down and touch the $1680 support level.

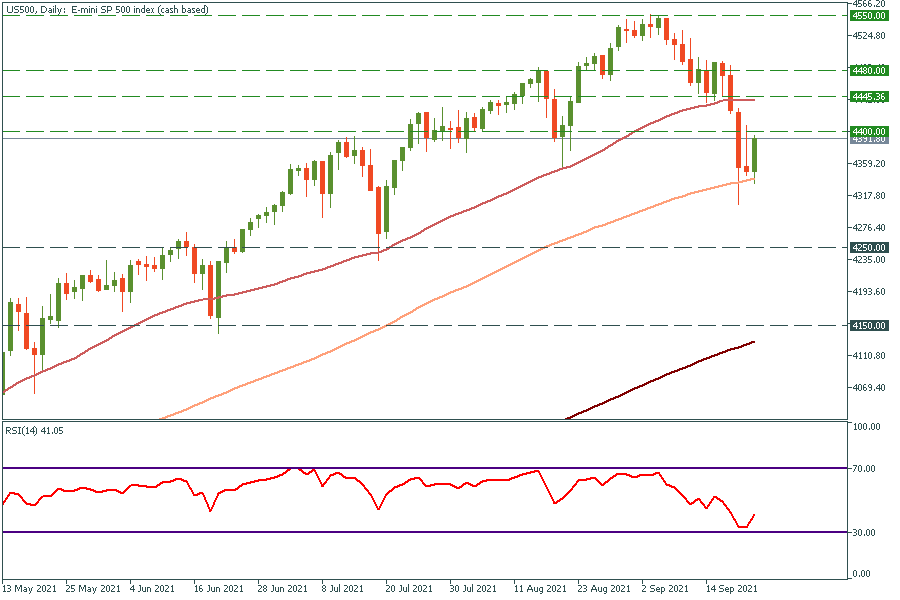

S&P500 (US500) daily chart

1st scenario will send S&P500 to 4450 and 4480 resistance levels.

2nd scenario will open a road to 4250 and 4150 support levels.

Bitcoin daily chart

1st scenario will make bulls push Bitcoin up to $47 000.

2nd scenario will send the main cryptocurrency down to $37 600 and probably even $30 000 levels.