Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaThe world’s largest oil exporters, OPEC+ nations, will meet on Tuesday. The meeting is expected to start at 15:30 GMT+3.

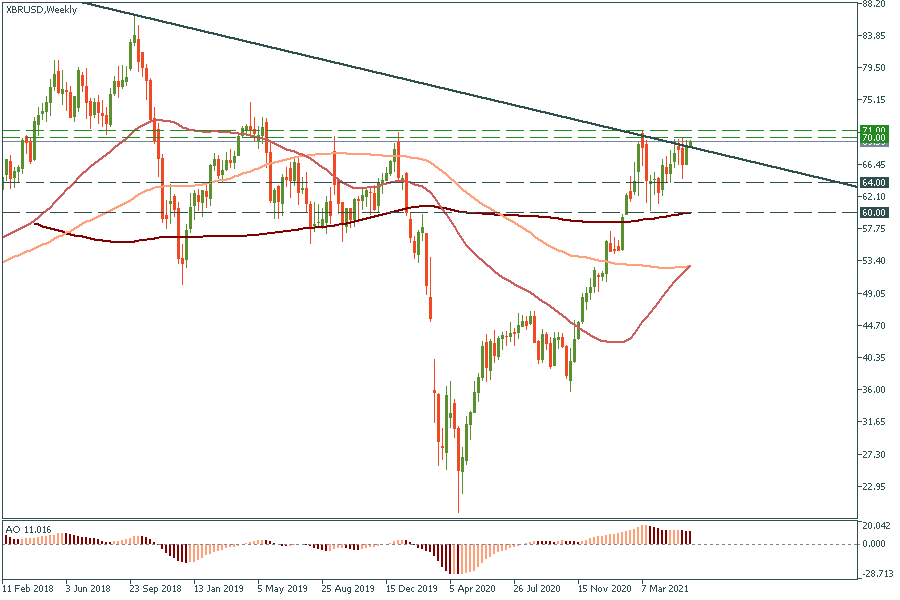

OPEC+ has a great impact on the oil supply. As the global economy is recovering from the pandemic, OPEC’s actions become even more important. If the organization has a positive view of the global economy and expects demand for oil to rise, it slowly increases production. This was the case in April when the countries announced a plan add more than 2 million barrels a day to global oil supplies from May to July. Since then, Brent oil has been trading with a bullish bias slowly drifting up toward March highs in the $71 area. This time, everyone expects OPEC+ to stick to the previous agreement. That will be a positive outcome for oil because it would mean that all is fine and exporters think that their barrels will find buyers.

On the downside, if OPEC voices concerns about the world’s economic rebound and emphasizes problems in particular regions (for example, India), we may see oil prices go down.

A new topic

Something has changed in comparison with April: Iran. The nation is in negotiations with the West to remove sanctions. If this happens, its oil will return to the market increasing the overall supply and changing the balance. Iran’s potential return is a negative factor for oil. Although the talks about Iran will likely last for months, any comments on this topic tomorrow may rock the price. Until the question remains decided, it’s going to limit the upside for oil.

It’s time to have a look at the chart. As you may see on the Weekly timeframe, XBR/USD has reached a very strong resistance area of $70-71 – here comes the resistance line that has been limiting the upside since 2014. Obviously, something really big and positive is needed for a major breakout to the upside. It’s hard to imagine that such a thing will materialize tomorrow. As a result, the best strategy may be to look for peaks as the opportunities to open sell trades targeting support at $66 a barrel.