Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaWhat will happen?

The European Central Bank will present the monetary policy statement on June 22. It is the primary tool the ECB uses to communicate with investors about its monetary policy. It contains the outcome of the bank’s decision on interest rates and commentary about the economic conditions that influenced it. Most importantly, it discusses the economic outlook and offers clues on the outcome of future decisions. The ECB usually changes the statement slightly at each release. These changes affect the strength of the European currency.

Technical analyses

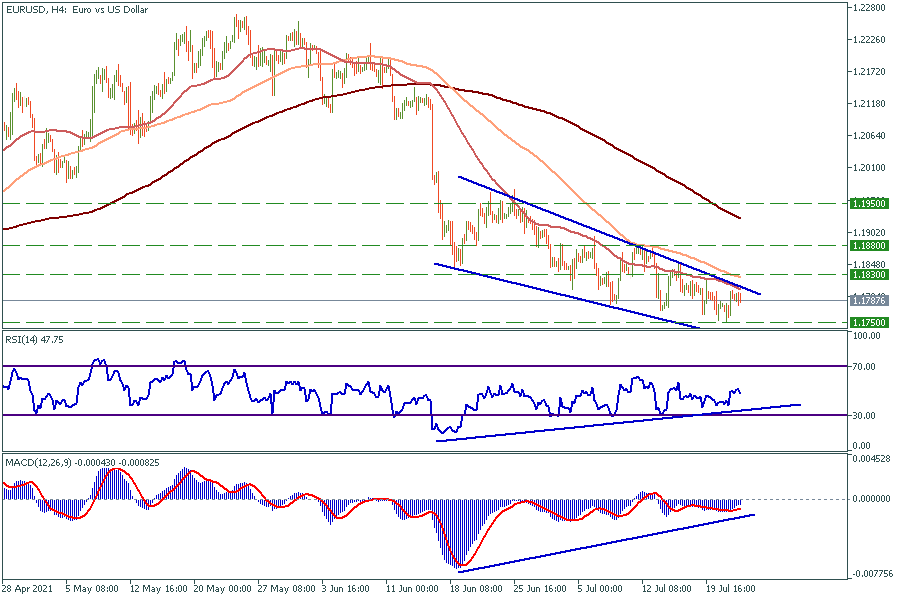

4H Chart

EUR/USD has formed the descending channel with divergences on RSI and MACD oscillators. This fact gives us the signal that correction is about to happen. If the ECB is less dovish than expected, EUR/USD will break the upper line of the channel and head towards the 100-period moving average, which is approximately 1.183. The next target, in this case, will be 1.188.

On the flip side, the downtrend will continue if traders get another confirmation that the ECB will do more monetary stimulus than the Fed. The price might drop to the support line at 1.175 and even lower at the bottom line of the channel at approximately 1.173.