Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaNobody even would be dare to say that such indices like S&P 500, Dow Jones, or Nasdaq will drop in the long term. It’s clear for everybody these well-known indices will rally up no matter what. Even Warren Buffet, one of the most famous investors, has advised his trustees to invest 90% of the money he will leave to his wife in a very low-cost S&P 500 index fund.

This is good advice for newbies and risk-averse investors. However, if you are willing to take a higher amount of risk to increase the potential size of your profit, you should invest the larger part of your capital into stocks. Let’s say 50% into stocks, 50% into indices (in this example we eliminate currency pairs and other assets).

Anyway, almost every investor has stock indices in his/her portfolio as they have one key advantage. An index, especially the popular one like S&P 500 or NASDAQ, is a low-risk investment as it’s an already diversified asset. If one stock loses its value, the other one will rise and offset the losses. Yes, the growth wouldn’t be too fast as some individual stocks may offer, but you will save yourself from unexpected huge losses. It's a so-called trade-off.

What stock indices to trade in May?

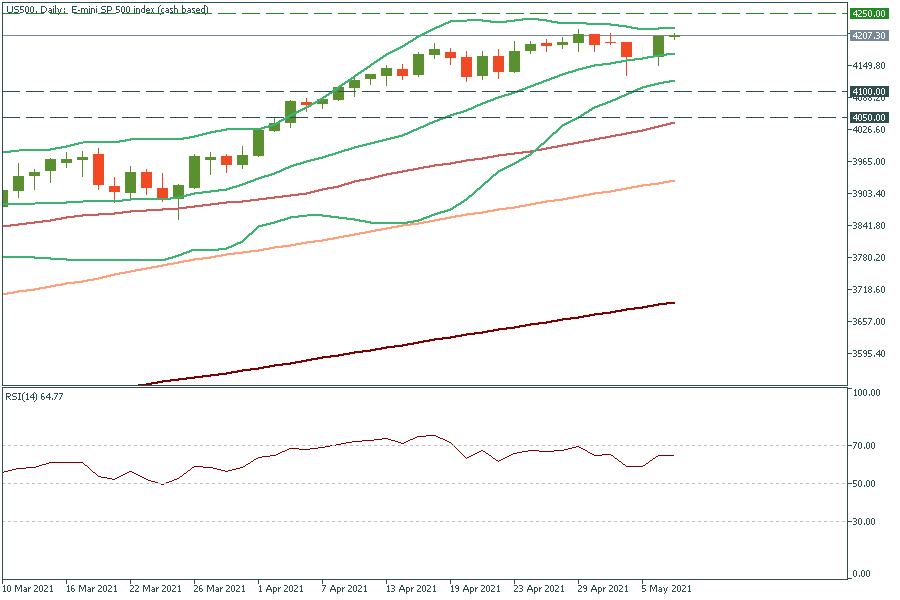

Tech outlook of S&P 500

US 500 (S&P 500) has just broken the psychological level of 4200. Thus, the way up to 4300 is clear now. However, the index wouldn’t grow fast to that price target, it’s likely to have struggled to move above the resistance zone of 4200-4250 as there is the upper line of Bollinger Bands, which the S&P 500 has failed to cross many times. Besides, keep an eye on the RSI indicator. Once it’s above 70.00, it will signal the index is overbought and thus it’s likely to reverse down.

It should be interesting to trade S&P 500 during NFP. If the report is better-than-expected, it may confirm bullish trends and help the stock index to rally up further. On the flip side, the poor NFP figures may worsen the market sentiment and trigger the sell-off of the index.