Trading Accounts

Trading Conditions

Financials

Trading Instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaIntel reported Thursday weaker-than-expected third-quarter sales results, with the stock falling more than 10% on Friday to around $50 a share. The company blamed supply shortages for a slowdown in its PC business. Moreover, the company is now mostly separated from Apple, which has created its own processors. All these create risks the company will have to deal with. On the other hand, Advanced Micro Devices (AMD) is reporting Q3 results today (October 26, 23:15), and we can’t help but to analyze the prospects of the main Intel rival.

Advanced Micro Devices Inc. (AMD) is a semiconductor company, that offers microprocessors that can operate as a GPU and APU (discrete graphics processing units and accelerated processing units). Its products are widely used in desktops, notebooks, game consoles, and servers.

The shortage of microchips might prompt an investor to believe that these are golden times for semiconductor manufacturers because high demand and limited supply can combine for higher prices and rising profits. But the low supply can also hurt sales in the short run.

The last AMD report was on July 27, and the company beat expectations. Earnings were $0.64 per share ($0.54 expected) on revenue of $3.9 billion ($3.6 billion expected). Also, the revenue grew 99.3% on a year-over-year basis (12% quarter-over-quarter growth). Such positive results boosted the price by 36% in 7 trading days. The company has stated that it expects 2021 annual revenue to grow by approximately 60.

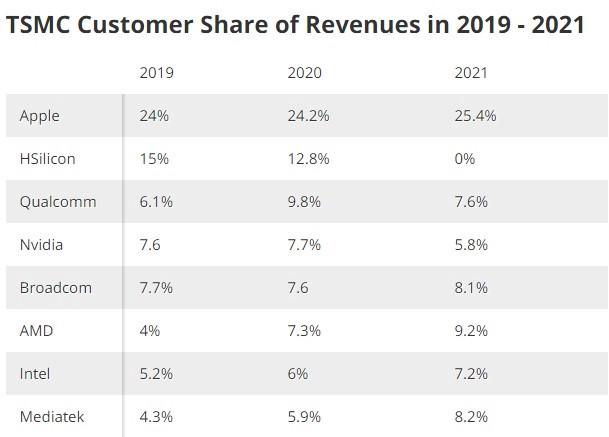

Also, AMD is increasing its share in revenues in the reports of Taiwan Semiconductor Manufacturing Co (TSM is the biggest chips producer in the world). Only two years ago Intel was in charge, but now the game has changed. If AMD manages to keep the relationship with TMS at a decent level, it will have an opportunity to negotiate on better prices and shipment.

Even that statements compare favorably with Intel’s ones. Couple that with the company switching its production to higher-margin chips and we get a strong mix of revenue and performance growth. Of course, we need to notice, that the stock price has already increased in anticipation of a good report, and after the results, we may see a fixation of the profit. Nevertheless, we expect the company to declare even bigger future revenue growth, thus, as an investment idea, AMD is a perfect opportunity.

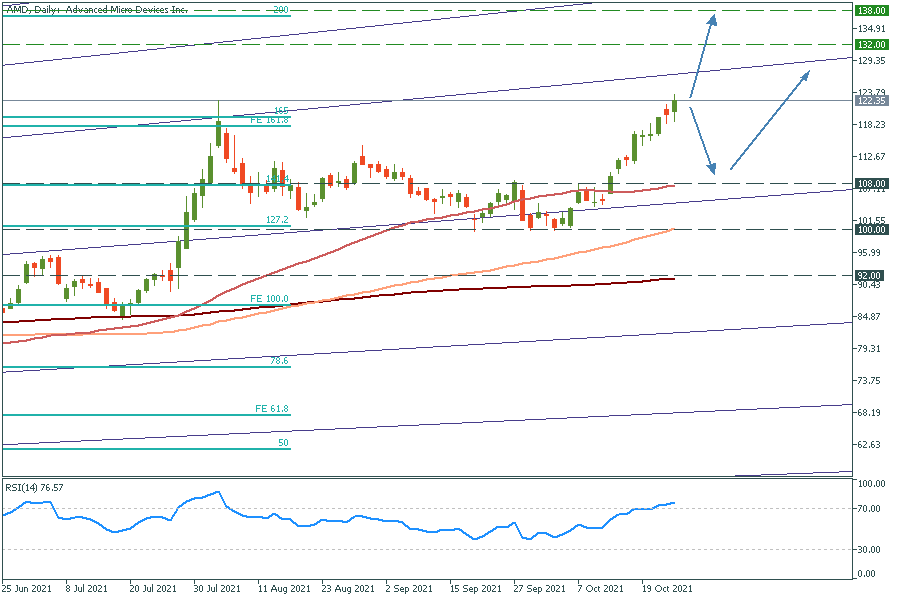

Despite such an upright chart, the stock has the chance to reach strong resistance at $138 and $150 per share, even after the possible pullback. To 50-day MA.

AMD daily chart

Resistance: 132: 138; 150

Support: 108; 100; 92

Don't know how to trade stocks? Here are some simple steps.