Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaIntel is going to unveil Q3 earnings results at the midnight from October 21 to 22 after the stock market closes. The market expects Intel to deliver earnings per share of $1.11 and revenue of $18.24B.

Last time, it was expected that Intel would post earnings of $1.06 per share when it produced earnings of $1.28. In general, the stock price should rise after upbeat results, but that situation was different. The report was better than expected but traders priced in the good outcome before (look at the series of green candles before the vertical line). Thus, when the actual numbers were out, the sell-off occurred. This time may happen the same. It’s so good that FBS traders can open both buy and sell trades while trading stocks.

Intel faces strong competition from AMD. Thus, Intel has to show really strong earnings results to signal investors that it can reduce the technology gap with AMD. For now, most forecasts are bearish for Intel. However, Intel’s processor chips are components in the vast majority of laptops and desktops. Intel’s chips are in high demand especially now amid the global semiconductor shortage. Thus, we can see a reverse up in the long term.

The stock price moves sideways between $52.00 and $55.00 inside the horizontal channel. If it manages to break above the 100-day moving average of $55.00, the doors will be open to the 200-day moving average of $57.25. On the other hand, if Intel breaks below $53.00 – the lows of late September/early October, the way to the bottom of the channel at $52.00 will be open.

IBM will report its Q3 financial results at the midnight from October 20 to October 21 (GMT+3). Earnings per share are expected to be $2.53 and revenue: $17.78B.

IBM’s third-quarter earnings results are likely to be strong as the company adopted its hybrid cloud computing capabilities and AI-related solutions. Besides, IBM has acquired Red Hat (software company), which should help IBM to increase its cloud segment’s revenue. Now, IBM has more than 3,200 clients. Among them are such giants as Barclays and Walmart!

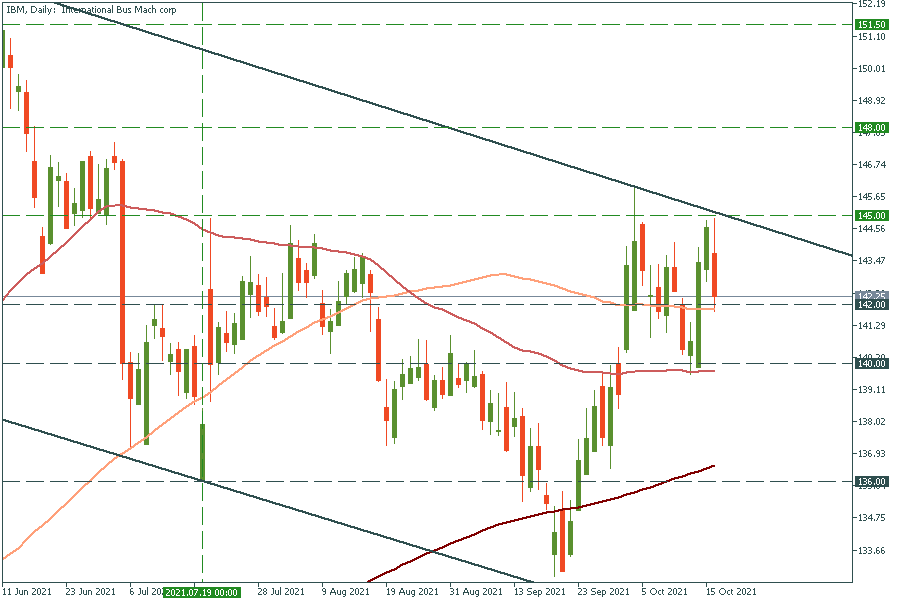

The previous report comes out on July 19 after the market closed. The report showed better-than-expected earnings but the stock dropped on July 20 (the day after the vertical green line) as the ‘buy the rumor – sell the fact’ scenario occurred. Nevertheless, the stock was rising for the next two weeks.

Now, the stock of IBM is moving inside the descending channel. If it falls below the 100-day moving average of $142.00, the way down to the 50-day moving average of $140.00 will be open. On the flip side, if IBM escapes the channel and breaks the upper line, it may rocket to $148.00 and then to $151.00.

Don't know how to trade stocks? Here are some simple steps.