Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

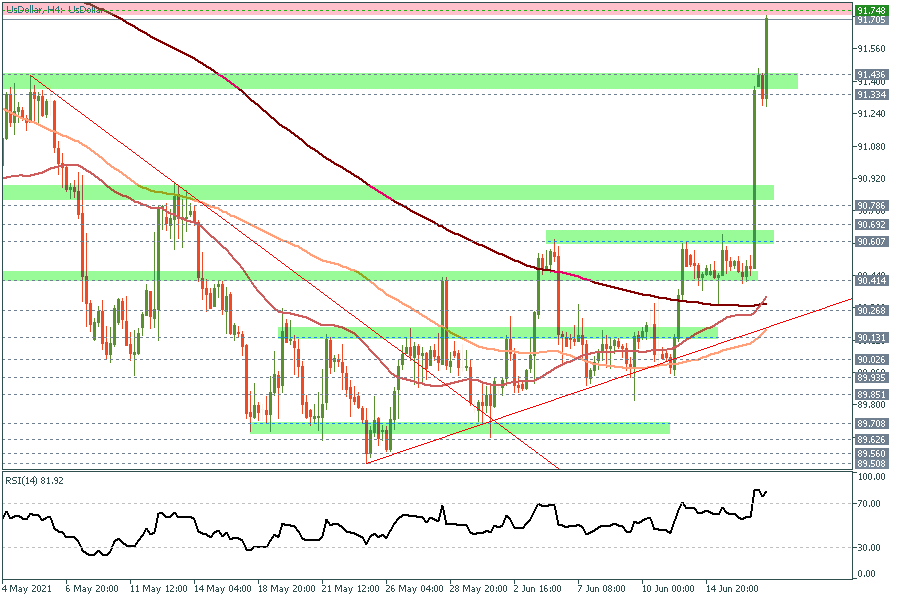

Personal area4H Chart

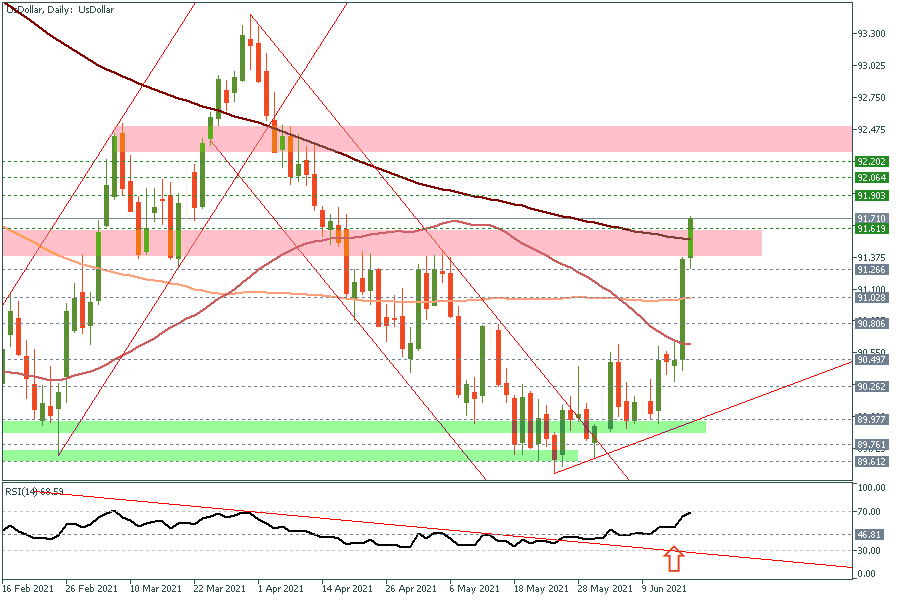

Daily Chart

The Federal Reserve kept the current policy as widely expected. However, the surprise came from the Dot Plot. In the March meeting, only 7 members saw a rate hike by the end of 2023, while in yesterday’s meeting this number has increased to 13. Moreover, the number of members who see a rate hike in 2022 has increased from 4 to 7. What this means is that the Fed now believes that rate hikes are coming sooner than before and might be faster, which also means that the QE tapering could be around the corner. With that being said, markets started to price in QE tapering right after the decision. Such a move is not only in the short term, but it can go for weeks and months. From now on, we would be looking to buy the US Dollar on dips as any downside move is likely to be limited above 89.0 – 90.0 area.

|

S3 |

S2 |

S1 |

Pivot |

R1 |

R2 |

R3 |

|

89.07 |

90.03 |

90.58 |

90.99 |

91.54 |

91.95 |

92.91 |