Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaYoshihide Suga left the position of Japan’s prime minister. This news juiced Japanese Markets as JP225 hit 30 000 for the first time since April 2021. Regardless of who wins the Sept. 29 leadership vote, the ruling Liberal Democratic Party is expected to perform better in a forthcoming general election than it would have under Suga.

Here are three favorite candidates:

Taro Kono

A favored candidate of foreign investors, a victory for Taro Kono would bring a fluent English speaker into the prime minister’s office. His candidacy is already helping boost sections of Tokyo’s markets.

Fumio Kishida

While not as popular with the public as Kono, some nonetheless see Kishida as the current favorite, including analysts at Citigroup Inc.

Kishida said he plans to use “vaccine passports” to normalize economic activity, which might provide sustained support to so-called reopening plays such as rail operators, airlines, travel agents, and restaurants.

Sanae Takaichi

She has the strongest lean towards adopting a reflationary policy. Sanae also calls for 100 trillion yen in spending on disaster prevention over 10 years.

Japanese parliament will officially name a new Prime Minister on Oct 4.

CAD/JPY, Daily chart

CAD/JPY gets squeezed between 50 and 100-day moving averages. The trend will be defined as soon as the price breaks through any of these two lines. The breakthrough any of MA will give the pair a huge impulse, that’s why we expect upcoming volatility.

At this moment it looks like the CAD/JPY is ready to drop to the 86.1 – 85.6 range, where some long trades might be opened. If the price breaks through and sticks under the 200-moving average, it will target 84.45.

In case, the price breaks through the 50-day moving average, 88.2 will be the first goal.

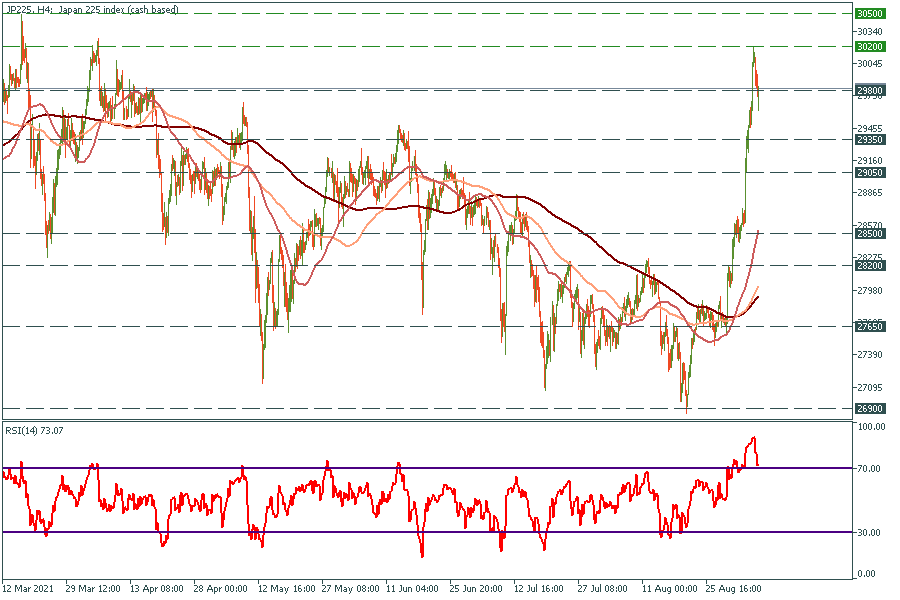

JP225

Daily chart

JP225 still did not reach the previous high at 30 500, but at this moment it looks overbought according to the RSI. We expect another pump to 30 200 level and a “double top” pattern to appear. The 30 200 – 30 500 range is perfect to open a short position with the target at 29 400 as tiny pullbacks always happen after such big movements.