Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaJohnson & Johnson, a huge pharmaceutical company, will announce its earnings results for the first quarter on April 20 at 15:30 MT. Let’s get ready!

It’s really easy! Just compare the forecasted earnings with the actual and follow the rule below.

The good news for FBS traders is that they can make both buy and sell trades while trading stocks –the rules are almost the same as for the currency pairs. So, you don’t need to already have an asset to sell it.

Not so good! As you may know, Johnson & Johnson has produced its coronavirus vaccine. However, the rollout didn’t go well. Firstly, it has been reported recently that 4 people (out of 5.4 million) who used this vaccine got blood clots. Thus, European regulators have already started investigating the side effects. Secondly, three US vaccination sites temporarily stopped administering J&J's vaccine this week. Finally, the factory's workers occasionally mixed up some vaccine elements last month and ruined 15 million doses. Thus, 62 million of the company's vaccine doses must be checked. It will slow down the supply.

However, if all these things are fixed, Johnson & Johnson could even become the best-selling COVID-19 vaccine. Yes, yes! It has two significant advantages:

1) it can be stored with standard refrigeration and

2) it can be given in one dose!

Johnson & Johnson is not just about the Covid-19 vaccine, it’s way more! It has a huge stable of drugs, some of them are frontrunners in their segments. Besides, the company has an amazing reputation: five consecutive years of annual revenue growth, an above-average dividend that has been increased for almost 60 years in a row!

Moreover, Johnson & Johnson is a value stock. Therefore, it can benefit from the current market rotation from growth to value stocks.

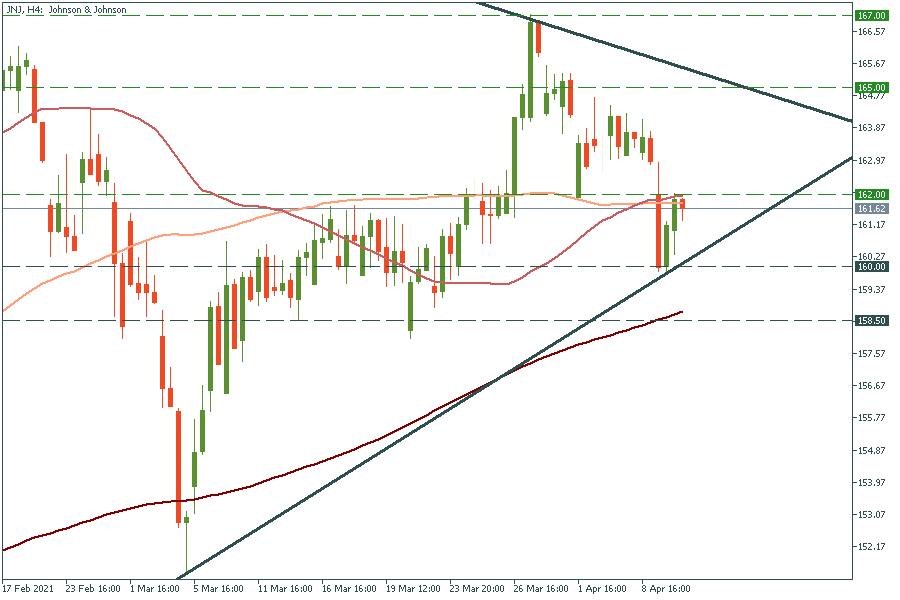

On the 4-hour chart, J&J has formed a symmetrical triangle pattern. Thus, the breakout above the upper trend line at $165.00 will drive the pair further up to March high of $167.00. However, first of all, it should cross the 50-period moving average which lies just above its current price of $162.00.

On the flip side, the move below the lower trend line at $160.00 will press the pair down to the 200-period moving average of $158.50.

Don't know how to trade stocks? Here are some simple steps.