Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaJohnson & Johnson is a unique company that is engaged in both consumer products and healthcare. Johnson & Johnson (JNJ) is one of the most popular dividend aristocrats trading on the market today.

Dividend aristocrats are S&P 500 stocks that have increased their dividends for at least 25 years straight.

JNJ has some problems with product liability, it faces many lawsuits related to its marketing of opioid drugs and even more lawsuits related to asbestos in JNJ baby powder. However, such kinds of companies are used to these headwinds. Litigation is just a cost of doing business. Think of tobacco companies. They have much more problems with it and their businesses still keep prospering.

Besides, this week was quite terrible for JNJ: its vaccine was linked to risks of Guillain-Barre syndrome: 100 reports of this syndrome among 12.8 million vaccinated people. It’s a small percentage, but it’s already the second warning for the JNJ’s dose (it was known in April that the vaccine causes the risk of blood clots). Apart from all that, now the company is recalling 5 sunscreen products.

JNJ will uncover its financial results for the second quarter on July 21 at 15:30 MT (GMT+3). Analysts expect the company to deliver $2.29 earnings per share and revenue of $22.52B.

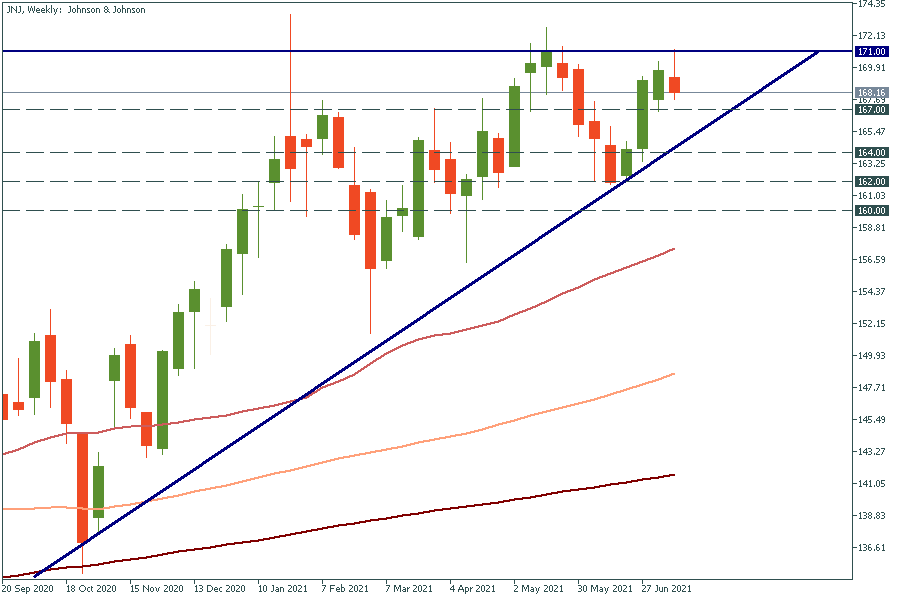

On the weekly chart of JNJ, the ascending triangle pattern was formed between the resistance level of $171.00 and the trend line. When the price goes above $171.00, the way up to fresh highs will be open. The next resistance levels will be at $175.00 and $180.00.

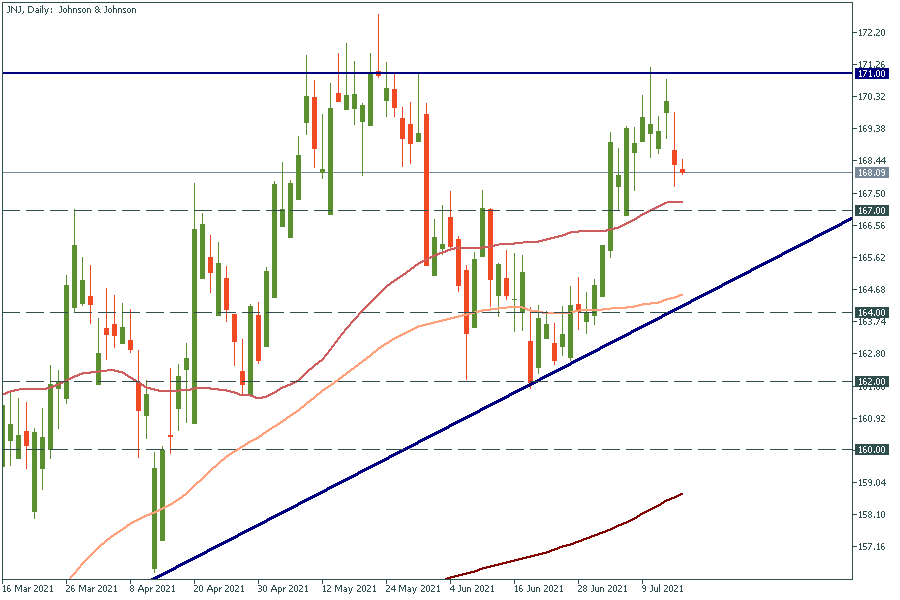

To look at support levels, let’s switch to the daily chart. The 50-day moving average of $167.00 should constrain the pair from further falling. However, the stock price goes below it, it may drop to the next support level at the 100-day MA of $164.00

Don't know how to trade stocks? Here are some simple steps.