Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaOn the last summer day, we would like to offer you to watch these significant upcoming moves.

Asian market finally enters recovery stage as Chinese (HK50) and Japanese (JP225) indexes demonstrate bit pump on Tuesday, August 31.

Let’s check the charts and set targets for this move!

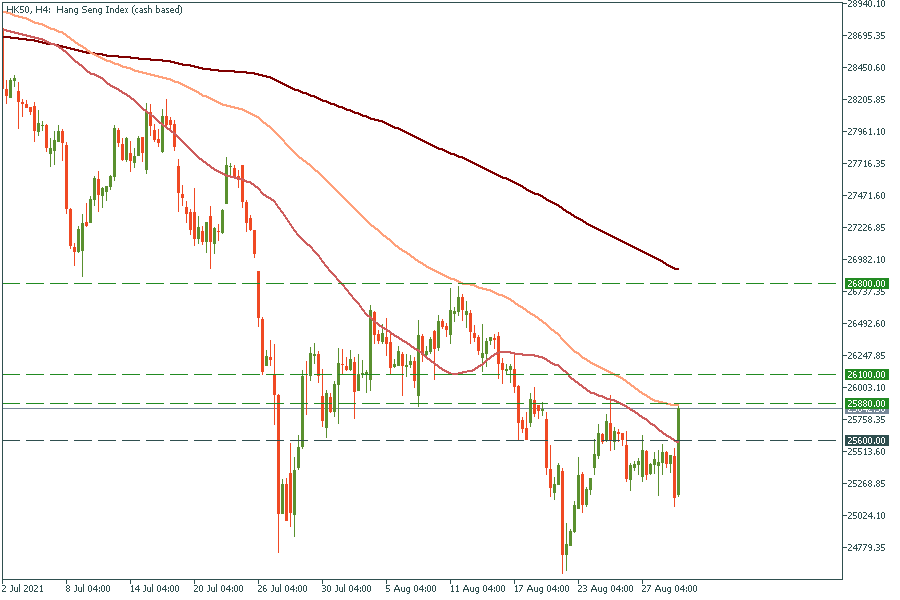

4H chart

Hang Seng 50 came to the 25.880 resistance level which matches with the 100-period moving average. It looks like buyers are taking it seriously and ready to push it higher. As soon as the price breaks this resistance level, we will get two targets of 26.100 and 26.800 levels respectively.

Daily chart

JP225 has formed a falling wedge pattern on the daily chart. The price is heading towards the 28.500 resistance level, which matches with 100 and 200-day moving averages. After the breakthrough, the price will move towards the previous high at the 30.500 level. The main support is 26.900, which is the bottom line of the wedge.

4H chart

Ethereum price has formed big resistance and support levels. The only way to trade this crypto asset is to wait until the battle between bulls and bears will be finished and join the winners. If the price breaks the upper line of the rising wedge, Ethereum will pump to $3550 and $3800. Otherwise, we might see a big correction to the $2850 and $2630 support levels.

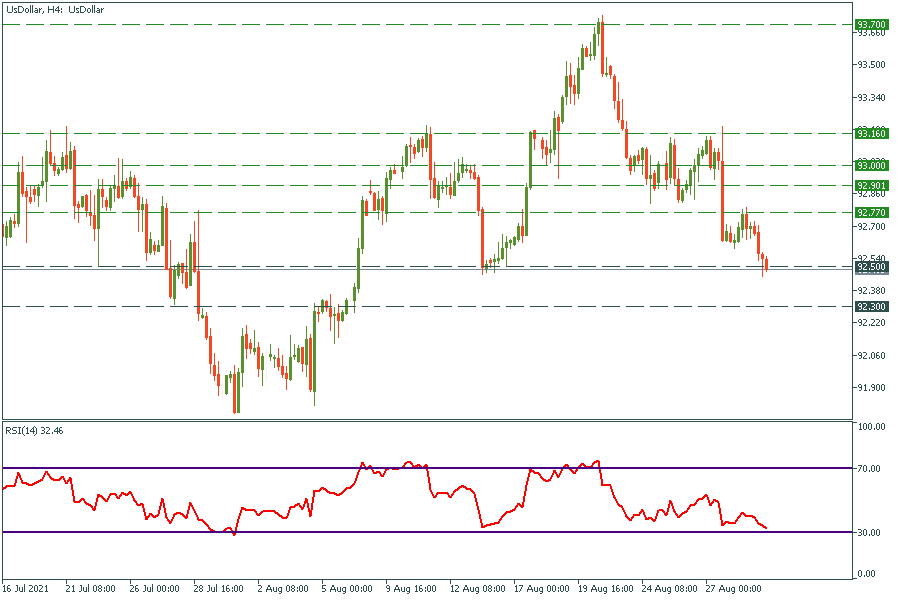

4H chart

It looks like the US dollar index is not going to give up so easily. At the moment, it is consolidating around 92.5. Combining with the RSI close to the oversold area we might suggest that the pullback is coming soon. The main target of that movement is 92.77. Unfortunately, if the US dollar index breaks through the 92.5 support level it will immediately drop to the next support, which is 92.3.