Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaWhat will happen?

Microsoft, the US IT company, will present its earnings report for the second quarter on July 27 after the stock market closes (23:00 GMT+3). The release will be followed by an investor conference call at 00:30 MT, July 28.

Microsoft splits its business into three similarly sized segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. Analysts are calling for strong growth across all three segments, as:

Analysts and experts forecast: Earnings per share = 1.91; Revenue = 44.06B

Technical analyses

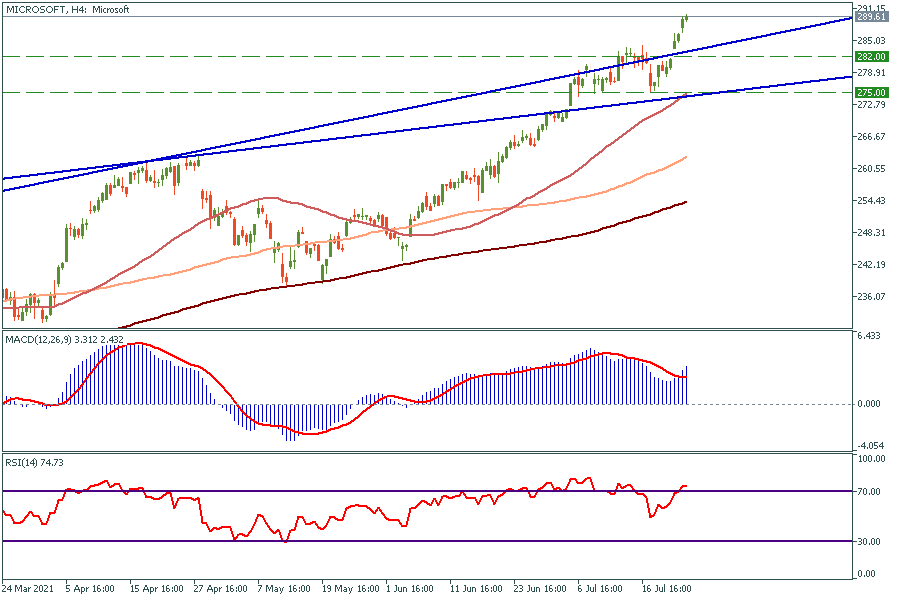

4H chart

Investors are awaiting a strong earnings report. They have been buying back the stock on every drawdown for a while. It might play a terrible trick since one of the most popular trading strategies says: “buy the rumor, sell the news”.

Microsoft stock looks overbought according to RSI and MACD indicators. Institutionals might fix profits and drop the price after the report as it happened after the last report was published. It is important to wait for the right time to open the position. The best time for it will be right after the report presentation, where it will be more clear which side “whales” pick to push the price at.

If the price drops it will meet the closest support levels at $282, $275. On the flip side, the target is $300.