Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaNetflix will post the earnings report for the first quarter on Wednesday, at 01:00 MT (GMT+3) time. Thus, we will see the company’s revenue and EPS after the market closes.

Forecasts:

EPS: $2.98 (+89.8% from the Q1 2020);

Revenue: $7138 million.

After impressive results in 2020, when Netflix’s number of subscribers surpassed 200 million amid the Covid-preventing lockdowns, the company needs to prove its dominance in the streaming world. While the subscription levels and the quality of shows in the platform remain on top, there is some slightly noticeable downturn in the download volumes and web traffic, according to SimilarWeb. However, positive factors for the Netflix stock still prevail. For example, the number of subscription cancellations remained low in March despite the price hikes. Therefore, there are high chances of the actual data beating estimates during the upcoming release.

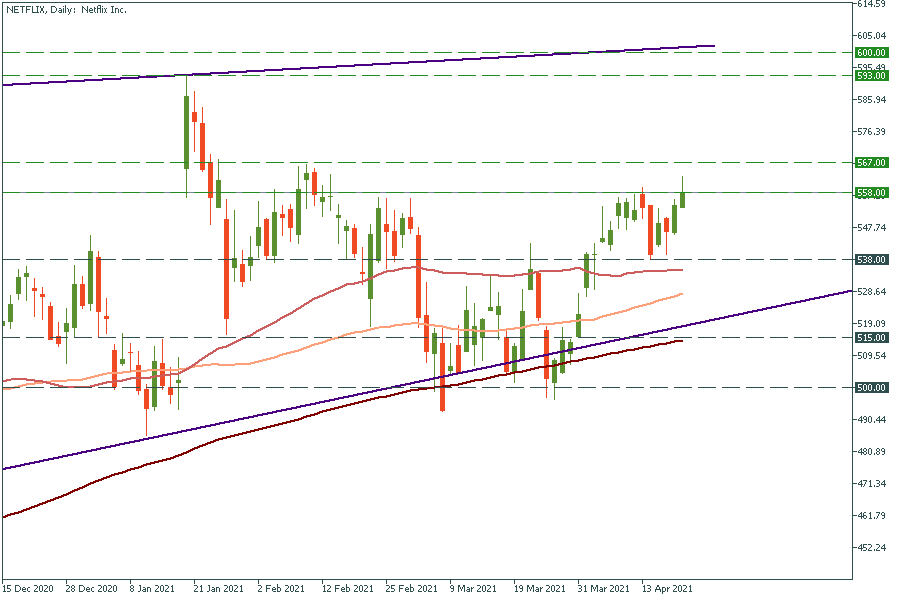

The Netflix stock has been in a long-term consolidation between the $500 and $567 levels. The release of the earnings data may change the performance of NETFLIX. If the results outperform the forecasts, the stock will soar above $558-567 towards $593-600. On the other hand, the slide below $538 will happen. In this kind of scenario, the next obstacle for bears will be a strong one, as it will lie near the ascending trendline and 200-day SMA. If the earnings are mixed, the stock will continue trading sideways between the support of $515 and the resistance zone of $558-567.

Keep in mind that the report will come out when the stock market will be shut. Thus, there may be gaps in the chart of the Netflix stock after the market opens. If a gap occurs, the price may try to fill it in. As a result, a stock may move in the opposite direction after the gap.

For example, if earnings are disappointing, the gap down may appear right after the market opens at 16:30 MT (GMT+3) time. After that, the stock has a high chance to rise.

Don't know how to trade stocks? Here are some simple steps.