Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaWhen Twitter Inc. and Snap Inc. posted quarterly revenue that blew past analysts’ expectations, the results bumped up the shares of the two of their larger rivals: Facebook Inc. and Alphabet Inc.

While Facebook and Google parent Alphabet doesn’t report their numbers until next week, the tech giants are also in the digital advertising business, and the reports from Twitter and Snap answered some lingering investor questions. The pandemic, which caused businesses to sell more of their products online, has started to subside in some parts of the world, but it turns out advertisers are still increasing their budgets.

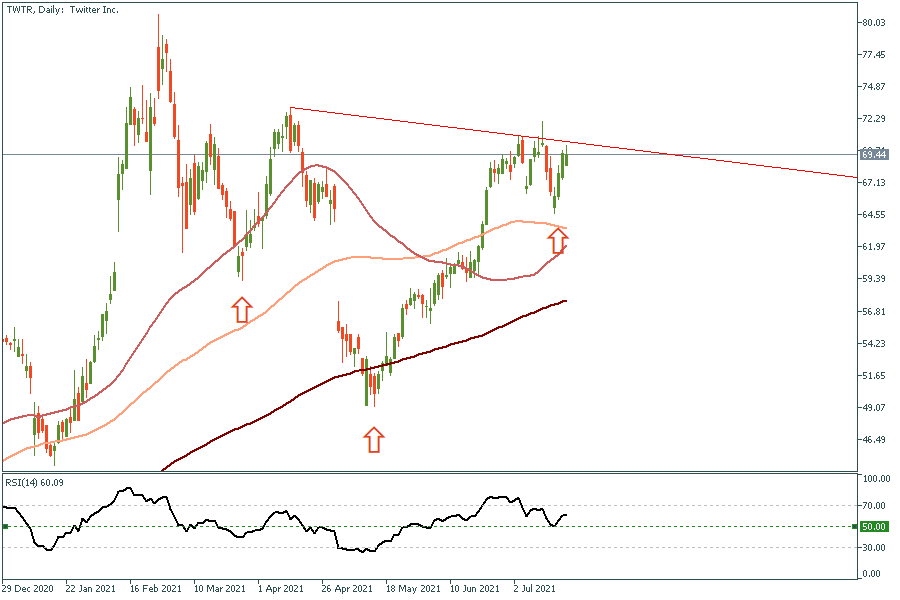

The momentum burst that we saw over the past few days after the quick dip at the beginning of this week is also considered as an early sign of a breakout including Facebook, SNAP, Twitter, and Google.

With that being said, it looks like the correction in tech stock is over and earnings may prove such an outlook.

Twitter showing some promising pattern here, with a possible inverted head and shoulders formation on the daily chart, while the neckline is now trading around 70.50 which might get tested in today’s session. A weekly close above the neckline would be a clear signal to start building a position gradually with every dip, with an initial target of 73.