Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

Personal areaNon-farm payrolls will come out on Friday at 15:30 MT (GMT+3). NFP is one of the most significant economic indicators for the US dollar and thus for most currency pairs on the Forex market. This indicator will reveal how many Americans got a job in April, excluding those who work in the farming industry. In general, the more people are employed, the better it is for the economy! Easy, right?

But let’s go a little bit further. NFP serves as a base for the future rate decision by the Federal Reserve – the US central bank. The high level of NFP increases the chances the Fed raises interest rates in the future, which will push the USD upward. On the other hand, the decline in the NFP figures signals the economic slowdown and reduces the possibility of rate hikes by the Fed, which is a negative factor for the USD.

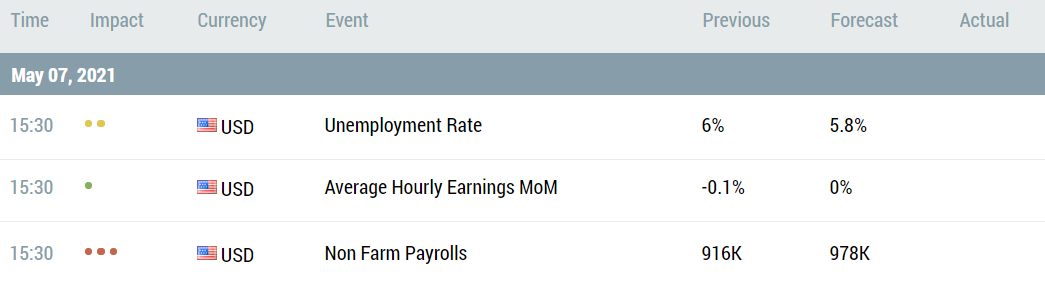

It’s necessary to pay attention not only to NFP but also to monthly average hourly earnings and the unemployment rate. So, there are three indicators to follow. Compare the actual numbers with the market expectations and follow the rule below.

*The market reaction tends to be like that, but it doesn’t mean it will happen 100%.

You can see the forecasts in the picture below. To check actual numbers, go to the economic calendar at 15:30 on Friday. After the impressive 916,000 gain in March, the US economy is on course to add another 978,000 jobs in April. Some analysts believe the number can top 1 million. It would be an event to see!

There were talks among investors that the Fed is going to hike rates soon as the recovery is faster than expected and inflation is rising, so the Fed should take actions not to allow the economy to overheat. Actually, Treasury Secretary Janet Yellen gave voice to the same thought yesterday, but then downplayed it. However, that was enough to send the USD soaring. Indeed, the last word is on the Fed but any tapering comments tend to move the US dollar higher.

In short, the main question for traders is when the Fed starts tapering (cut asset purchases and then raise rates). Therefore, NFP is not just some labor figures, it’s a key issue for the further Fed’s policy, which is the main driver for the USD.

As mentioned above, NFP will impact currency pairs with the USD such as EUR/USD, GBP/USD, AUD/USD, USD/JPY, etc. Besides, gold (XAU/USD) may be impacted as well. If NFP figures are better-than-expected, the USD will rise and drive EUR/USD, GBP/USD, AUD/USD, and gold down, while USD/JPY and USD/CAD up. If worse, the USD will fall and drive EUR/USD, GBP/USD, AUD/USD, and gold up, while USD/JPY and USD/CAD down.

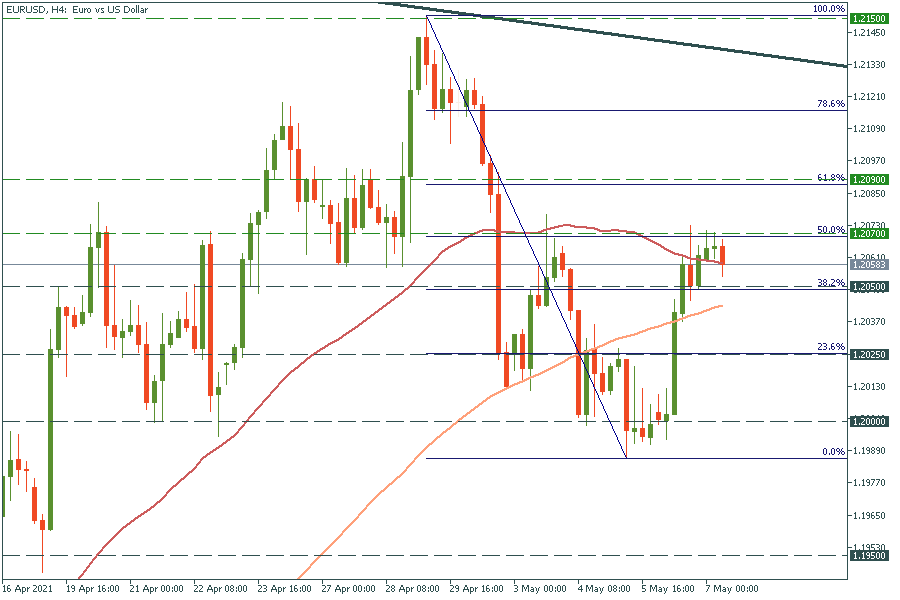

EUR/USD has failed to break the 50% Fibonacci retracement level of 1.2070 so far. If NFP figures are worse than expected, EUR/USD is likely to break the resistance of 1.2070, so the way up to the 61.8% Fibo level of 1.2090 will be open. On the flip side, if NFP figures are better than expected, the pair may drop, and move below the 38.2% of 1.2050, which in turn will open the doors towards the next support of 1.2025.