Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

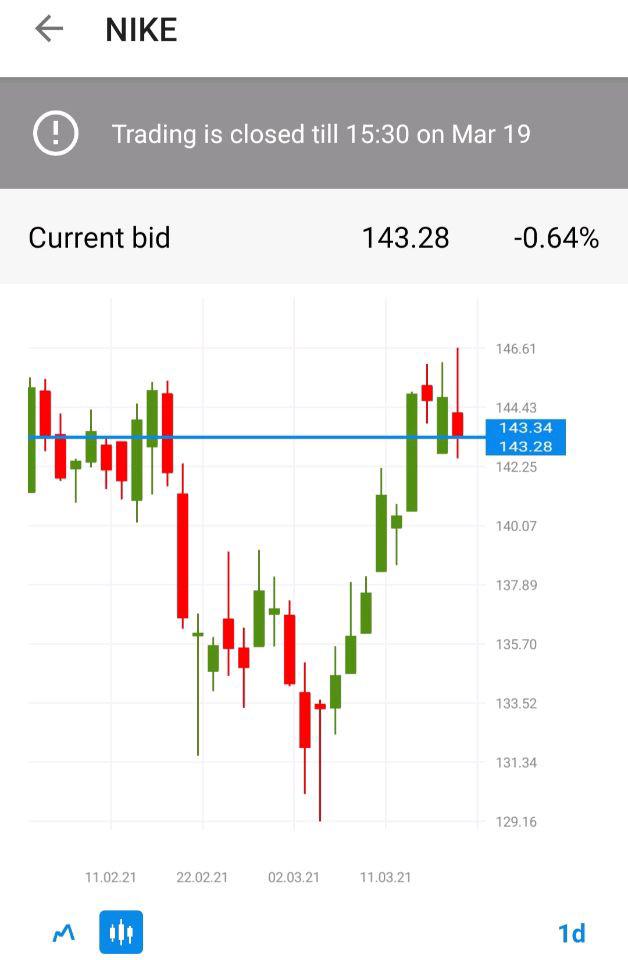

Personal areaYesterday, Nike reported better-than-expected earnings: a profit of 90 cents a share vs the projected 76 cents. However, the sales came out much worse than anticipated. Sales were $10.4 billion, which is below analysts’ estimates of $11 billion. In Europe, revenues dropped as many stores remain closed due to the Covid-19 pandemic.

Besides, there are some serious problems with the supply chain. A huge part of Nike’s sneakers just weren’t delivered to North America, its biggest market. As a result, in North America, revenue dropped 10% year over year. For comparison, in China, where the virus has been taken under control a long time ago, sales rose by 51%!

By the way, while Covid-19 was devastating for street shops, online shopping has hugely improved. E-commerce has helped Nike to increase online orders, which sales climbed 59% last quarter.

The whole effect was negative, so Nike can continue dipping today. It may reach the 50-day moving average of $140.00, which it will struggle to cross on the first try. If it crosses it, the way to the low of March 9 at $135.00 will be open. We shouldn’t forget that after the fall always goes the rise. So, when the price bounces off the dips and crosses the resistance zone of $145.00-147.00, the way up to the key psychological mark of $150.00 will be open. The good news for FBS traders is that they can make both buy and sell trades.

Don't know how to trade stocks? Here are some simple steps.