Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

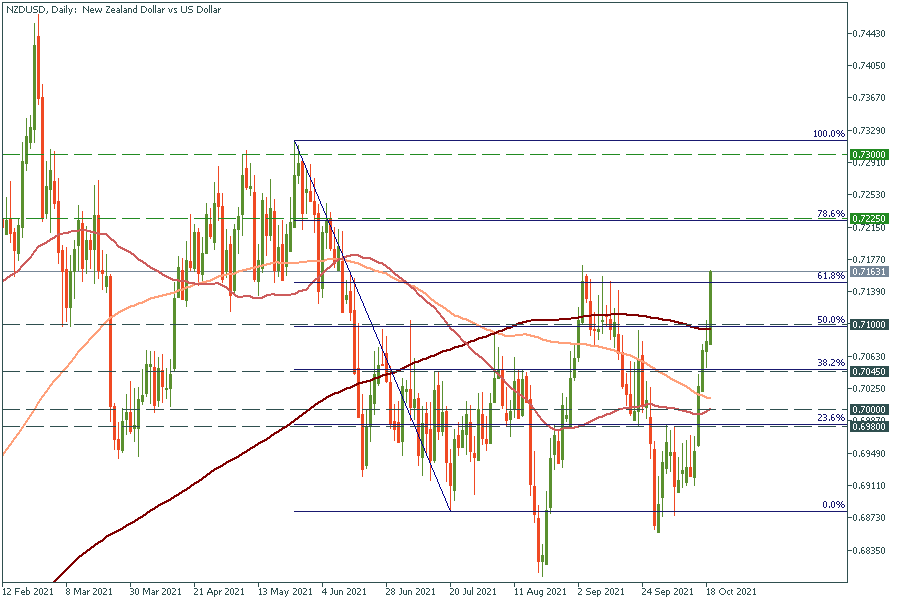

Personal areaThe safe-haven US dollar experienced a strong sell-off on Tuesday and plunged to the three-week lows amid the risk-on market sentiment. As a result, the riskier New Zealand dollar skyrocketed and pushed the NZD/USD pair up to the resistance level of 0.7150. Actually, it’s quite a strong resistance level as it lies at the 61.8% Fibonacci retracement level and also the September peak. Thus, we might expect the pair will struggle to break it on the first try and may even correct down to the 200-day moving average of 0.7100. Nevertheless, if the pair manages to close above 0.7150, it can rocket to the 78.6% Fibo level at 0.7225.

Commerzbank, the German bank, foresees NZD/USD to rally to the 0.7462/0.7559 long-term pivot. It’s a long-term price target which the pair may reach in several months. Before that, it can have pullbacks, be ready for that.

First, follow the overall market sentiment. the NZD is perceived as a riskier currency and thus it tends to rise in times of upbeat market sentiment. Secondly, New Zealand has revealed its inflation figures on Monday, which were better than analysts expected. The high inflation, in turn, can force the Reserve Bank of New Zealand to start tightening the policy, which will push the NZD up.

Read our article about the most important news to trade on.