Trading Accounts

Trading Conditions

Financials

CFD Trading instruments

Don’t waste your time – keep track of how NFP affects the US dollar!

The ASIC policy prohibits us from providing services to clients in your region. Are you already registered with FBS and want to continue working in your Personal area?

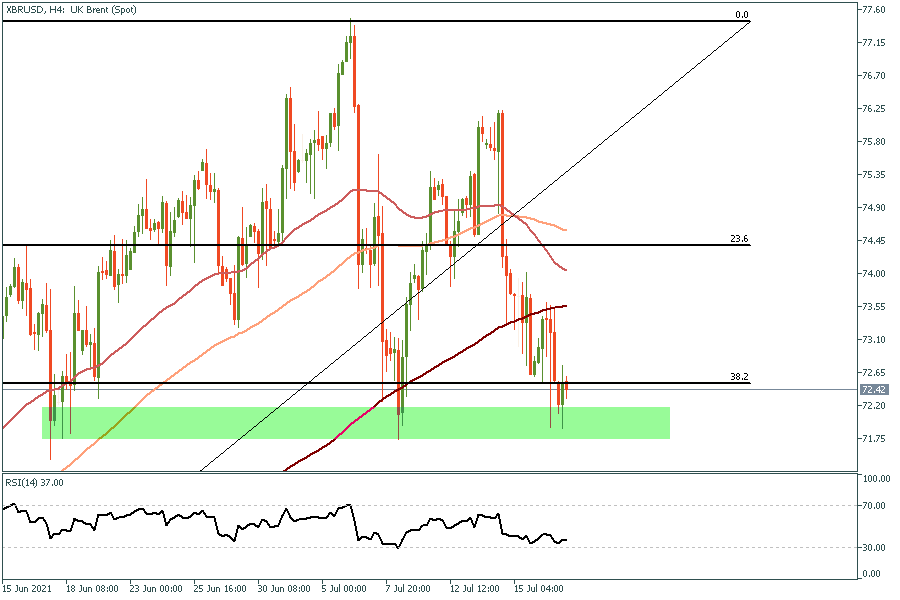

Personal area4H Chart

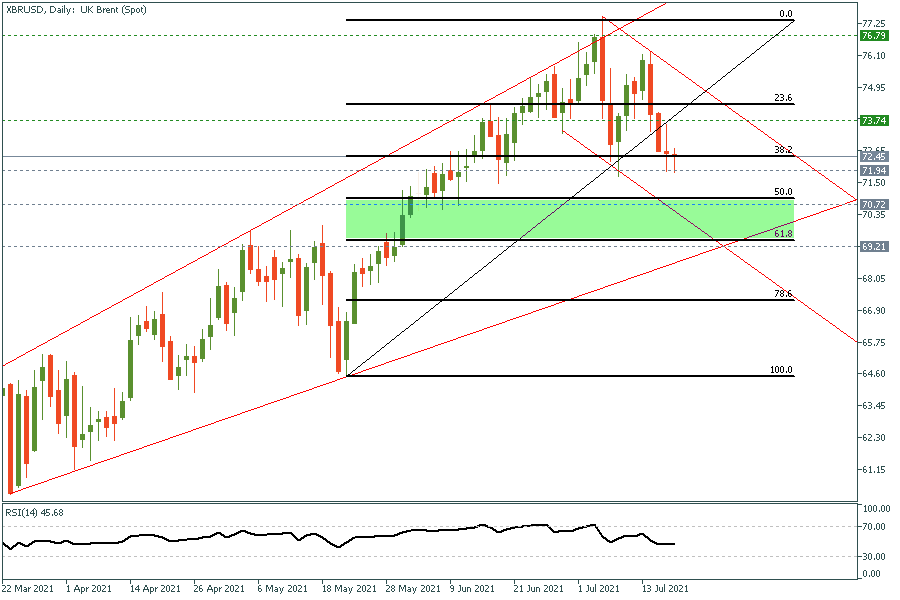

Daily Chart

Crude Oil began this week sharply lower after last week’s dramatic move due to OPEC+ drama which ended right before the opening bell of this week. In our last week’s video, we issued a signal to short Brent Crude between 75.50 and 76.60. Moreover, in yesterday’s note, we mentioned that it's wise to close some of the positions and move the Stop Loss to our entry. As of today, Crude fell by more than $5 from our selling zone. In the meantime, it would be wise to close all our positions and wait for another opportunity. In the coming days, any upside retracement is likely to remain limited below $71, which might be a new opportunity to short, but we will send out the signal when we execute the trades.

|

S3 |

S2 |

S1 |

Pivot |

R1 |

R2 |

R3 |

|

68.20 |

68.40 |

68.54 |

68.74 |

68.88 |

69.08 |

69.22 |